MicroStrategy (MSTR) dipped below its net asset value (NAV) for the first time in about two years on Friday as the broader crypto market continued to sell off sharply.

Bitcoin (BTCUSD), the company’s primary treasury reserve, has been in a sharp downtrend since early October largely due to macroeconomic uncertainty stemming from the U.S. government shutdown.

A concerning decline in BTC price to under $95,000 made MicroStrategy stock dip below $200 today, pushing its market-to-NAV ratio to an alarming 0.977x.

Significant of NAV Development for MicroStrategy Shares

A stock trading below its net asset value is often seen as a warning sign, especially for a business like MicroStrategy that has its valuation tied to Bitcoin.

The drop below NAV suggests investors are no longer willing to pay a premium for the company’s crypto exposure, a stark contrast to the past two years during which MSTR shares remained handily above it.

The development also raises concerns of confidence in MicroStrategy’s ability to manage volatility or capitalize on Bitcoin’s long-term potential.

In short, MSTR shares extended losses today because the NAV news reflects skepticism about the Nasdaq-listed firm’s broader strategy amid continued unease in the crypto space.

Michael Saylor Sees MSTR Shares’ Weakness as Temporary

Despite market jitters, Michael Saylor, the company’s executive chairman, remains unfazed.

Speaking with CNBC today, he dismissed rumors that MicroStrategy is trimming its exposure to BTC. In fact, the Virginia-headquartered firm has “accelerated its purchases” to leverage Bitcoin’s selloff.

“We’ll report our next buy on Monday morning,” he added. According to him, the ongoing Bitcoin selloff is “a temporary dislocation in a long-term secular trend.”

Saylor see the world’s largest cryptocurrency hitting $150,000 by the end of this year, which could alongside drive MSTR stock meaningfully higher from current levels.

How Wall Street Recommends Playing MicroStrategy

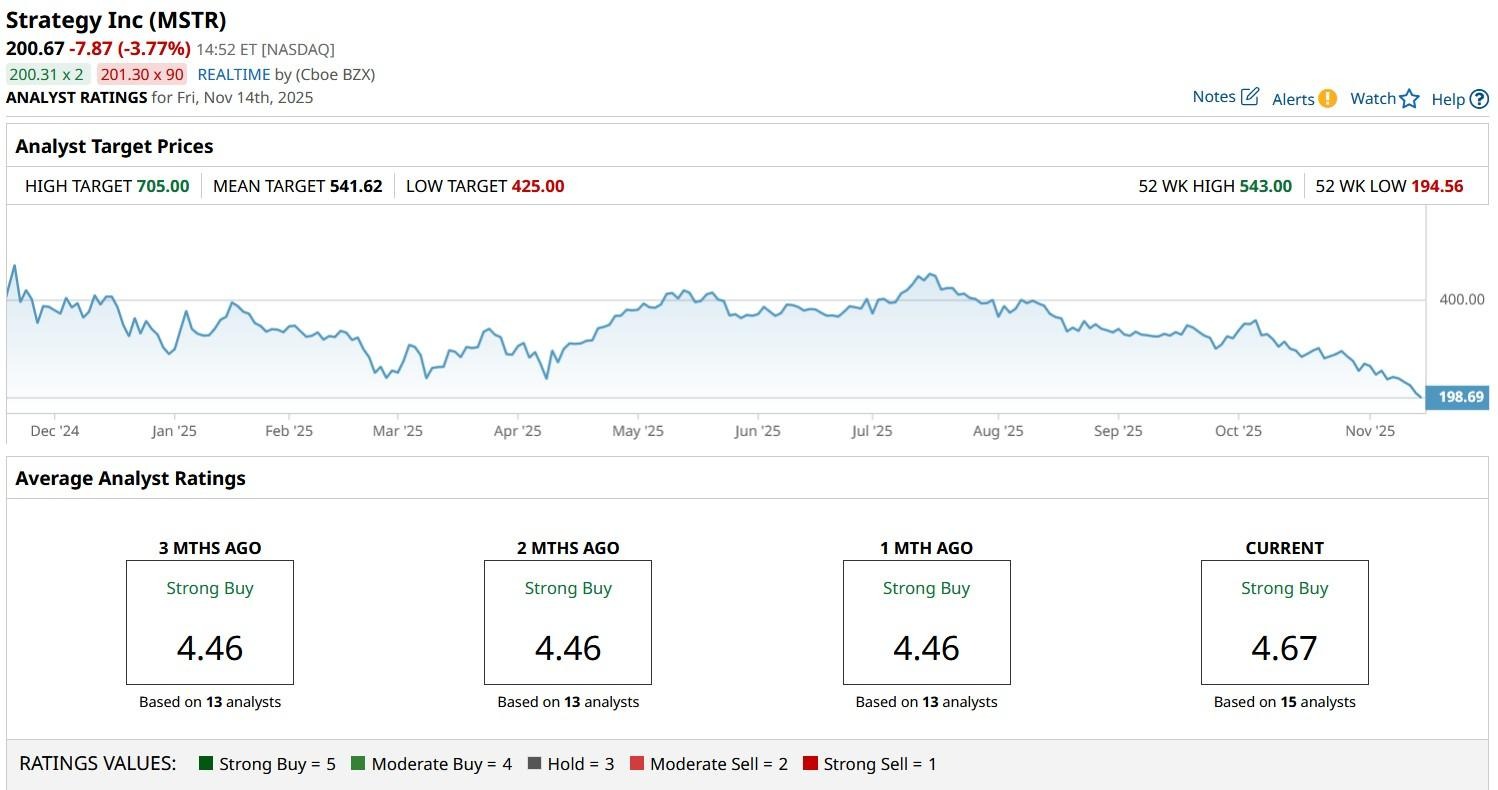

Wall Street analysts seem to agree with Saylor’s positive view on MicroStrategy shares, despite a massive decline over the past month.

According to Barchart, the consensus rating on MSTR stock remains at “Strong Buy” with the mean target of about $542 indicating potential upside of 170% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Barchart’s Technical Indicators Are Flashing ‘Buy’ as Warren Buffett Loads Up on 17.8 Million Shares of Google Stock

- Bullish Shares Are Down 35% in the Past Month. Should You Buy the Dip in BLSH Stock?

- MicroStrategy Falls Below Net Asset Value Amid Crypto Crash. Should You Buy the Dip in MSTR Stock?

- This Rare Earths Stock Is Expanding Its Footprint. Should You Buy Shares Now?