ConocoPhillips (COP) is one of the world’s largest independent exploration and production (E&P) companies, focused on discovering, producing, transporting, and marketing everything from Crude Oil and bitumen to LNG and natural gas liquids. With a market cap of $111 billion, its diversified portfolio spans key U.S. shale basins and international assets.

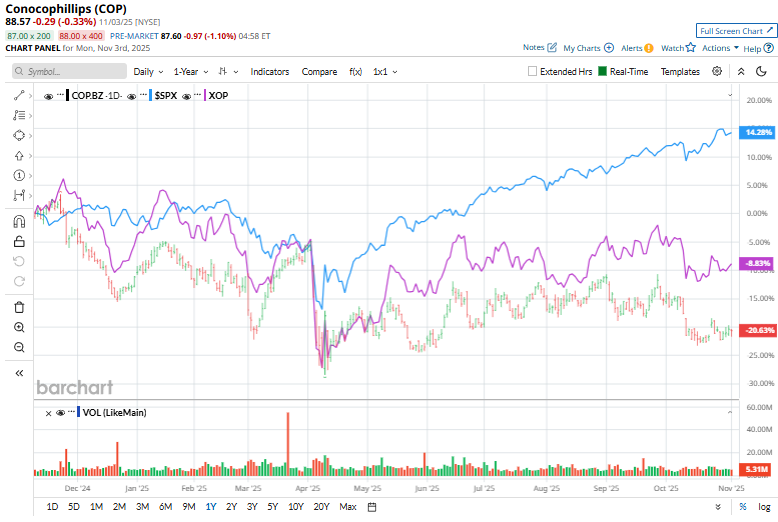

ConocoPhillips has faced a challenging stretch, with shares down 17.9% over the past year compared to the S&P 500 Index’s ($SPX) 19.6% gain. That trend has persisted in 2025, as the stock has declined 10.7% year-to-date while the $SPX has advanced 16.5%.

Relative performance within the energy space has also been soft, with the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) falling 1.3% over the last 52 weeks and 3.6% in 2025.

On Oct. 23, ConocoPhillips gained more than 2% as energy stocks rallied alongside a more than 5% jump in WTI crude oil prices to a two-week high.

For fiscal 2025, ending in December, consensus estimates call for EPS of $6.25, implying a 19.8% year-over-year decline. Still, the company has exceeded earnings expectations in each of the past four quarters, demonstrating continued execution strength.

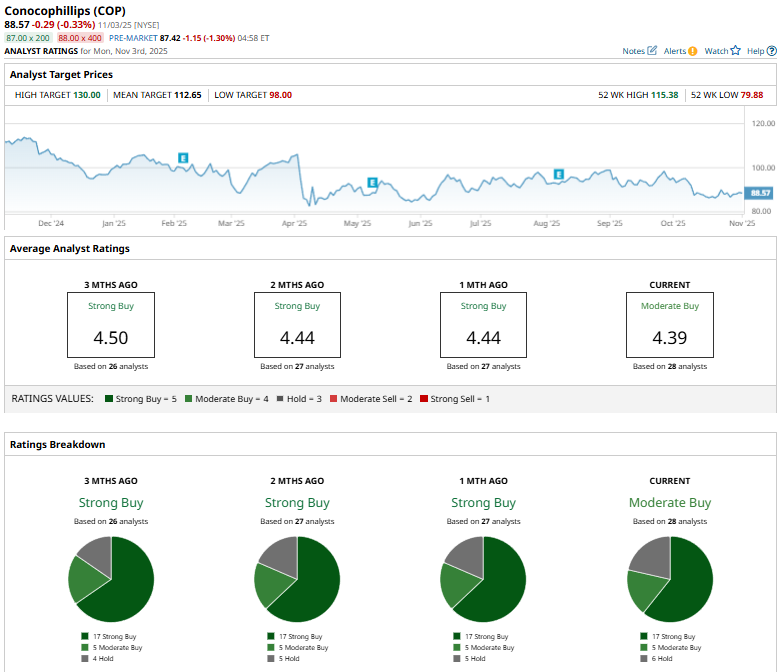

Among 28 analysts covering COP stock, the consensus rating is a "Moderate Buy," comprising 17 "Strong Buy" ratings, five "Moderate Buys," and six "Holds."

The configuration has been relatively stable for the past months.

On October 14, UBS analyst Josh Silverstein reaffirmed a “Buy” rating on ConocoPhillips and set a $122 price target.

The mean price target of $112.65 represents a 27.2% premium to COP’s current price levels. Meanwhile, the Street-high price target of $130 suggests a potential upside of 46.8%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart