Boston, Massachusetts-based BXP, Inc. (BXP) is the largest publicly traded developer, owner, and manager of premier workplaces. Valued at $11 billion by market cap, the company operates as a real estate investment trust (REIT), including properties owned by joint ventures totaling 53.5 million square feet and 186 properties. The REIT is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

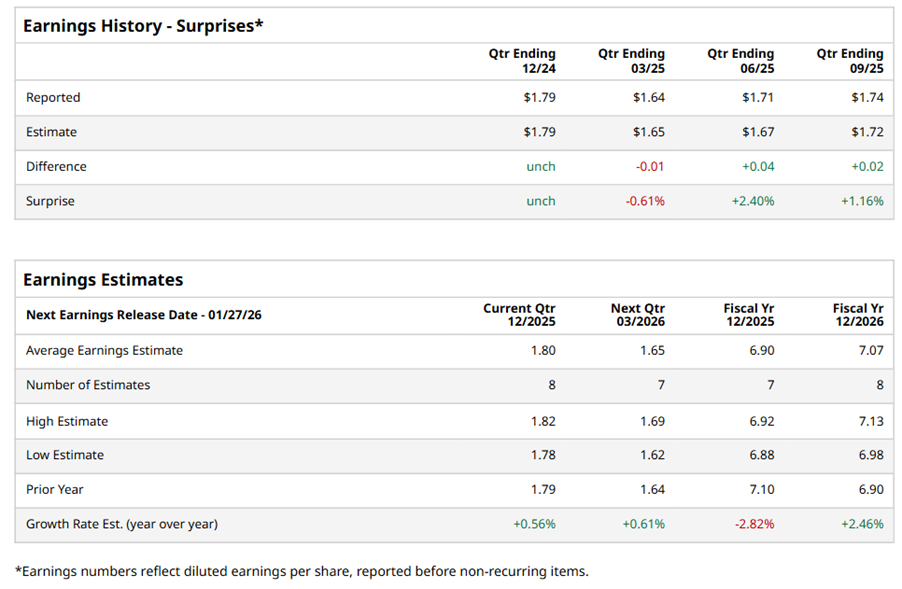

Ahead of the event, analysts expect BXP to report an FFO of $1.80 per share on a diluted basis, up marginally from $1.79 per share in the year-ago quarter. The company surpassed or met the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect BXP to report FFO of $6.90 per share, down 2.8% from $7.10 per share in fiscal 2024. However, its FFO is expected to rise 2.5% year over year to $7.07 per share in fiscal 2026.

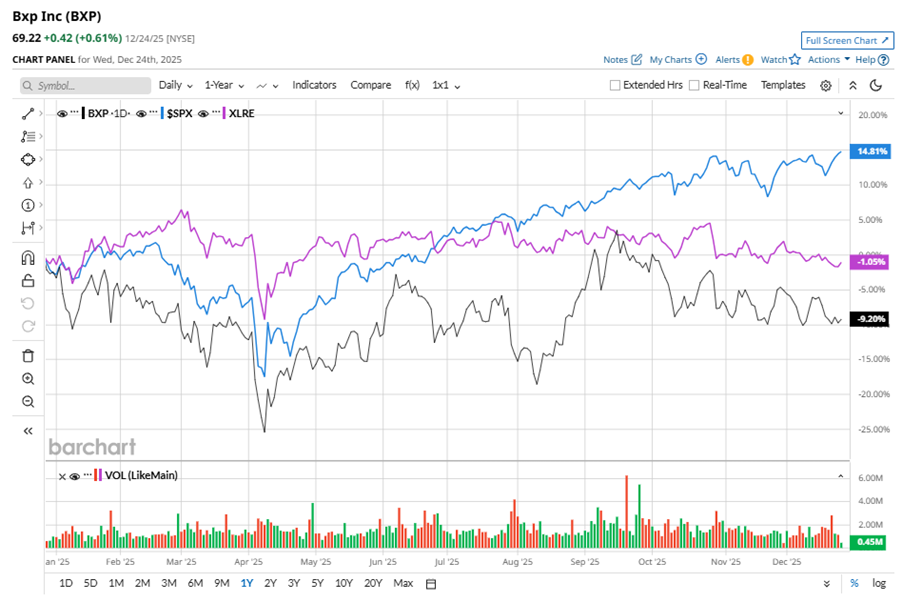

BXP stock has underperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares down 9.1% during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) marginal losses over the same time frame.

On Oct. 28, BXP reported its Q3 results, and its shares closed down more than 5% in the following trading session. Its FFO of $1.74 per share surpassed Wall Street expectations of $1.72 per share. The company’s revenue stood at $871.5 million, up 1.4% year over year. BXP expects full-year FFO in the range of $6.89 to $6.92 per share.

Analysts’ consensus opinion on BXP stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, 10 advise a “Strong Buy” rating, and 13 give a “Hold.” BXP’s average analyst price target is $78.85, indicating a potential upside of 13.9% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Giant Yielding 4.5% Is Wall Street’s Top Telecom Pick for 2026

- Have a MERRY Christmas With These 9 Unusually Active Options

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?