Advanced Micro Devices (AMD) shares closed nearly 6.5% higher on Jan. 13 after KeyBanc analyst John Vinh raised his rating on the chipmaker to “Overweight.”

In his latest research note, Vinh said “hyperscaler demand” will drive the multinational up another 23% to an all-time high of $270 over the next 12 months.

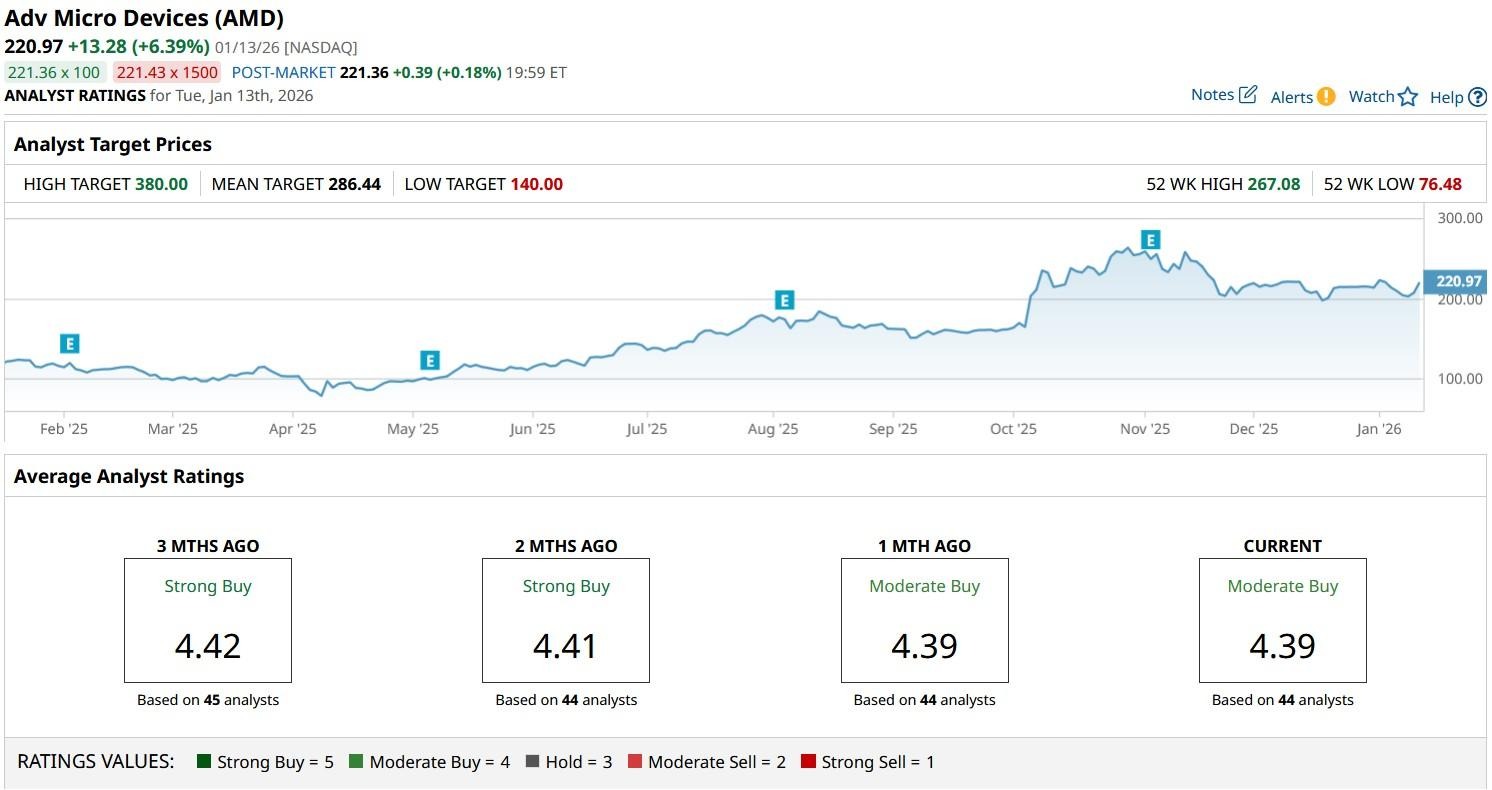

KeyBanc’s report offers investors a strong enough reason to stick with AMD stock that’s currently down more than 15% versus its 52-week high.

Why Is KeyBanc Bullish on AMD Stock?

Vinh remains bullish on AMD shares primarily because the semiconductor firm is nearly sold out of server CPU capacity for 2026.

According to him, the Nasdaq-listed firm is “considering a price increase of up to 15%” in the first quarter, which could help its stock regain some of the lost ground in the months ahead.

The KeyBanc analyst sees demand for the company’s MI355 and MI455 accelerators to push its artificial intelligence (AI)-related revenue up to as much as $15 billion this year.

Additionally, AMD has authorization to repurchase roughly $10 billion worth of its stock in 2026, which makes it even more attractive as a long-term holding.

Upcoming Earnings May Push AMD Shares Higher

John Vinh expects AI chips to make up at least one-third of AMD’s revenue this year, reinforcing that the company is gaining share in that fast-growing market.

In the near-term, the company’s upcoming earnings could prove a catalyst that drives its stock up significantly from current levels.

AMD is scheduled to report its Q4 financials in early February. Consensus is for the chipmaker to grow its earnings by 25% on a year-over-year basis to $1.10 per share.

At the time of writing, the longer-term relative strength index (100-day) sits at about 54 only, indicating AMD shares’ recent rally may not be out of juice just yet.

Wall Street Remains Positive on AMD

Interestingly, other Wall Street analysts are currently even more bullish on AMD stock than John Vinh.

According to Barchart, the consensus rating on AMD shares sits at “Moderate Buy,” with the mean target of about $286 indicating potential upside of another 30% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Juiced the Bull Case for Lockheed Martin to $1.5 Trillion. Does That Make LMT Stock a Buy Here?

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- This 1 Greenland Stock Has Surged in the Past Month. Should You Chase the Rally Here?

- This Memory Stock Is Up 745% in the Past 6 Months. Is It Unstoppable?