SanDisk (SNDK) shares closed more than 25% higher on Tuesday after the Nasdaq-listed firm rebranded its internal solid-state drive lineup as “SanDisk Optimus™.”

The rally pushed SNDK’s short-term relative strength index (9-day) to 85, signaling overbought conditions that often precede a sharp pullback.

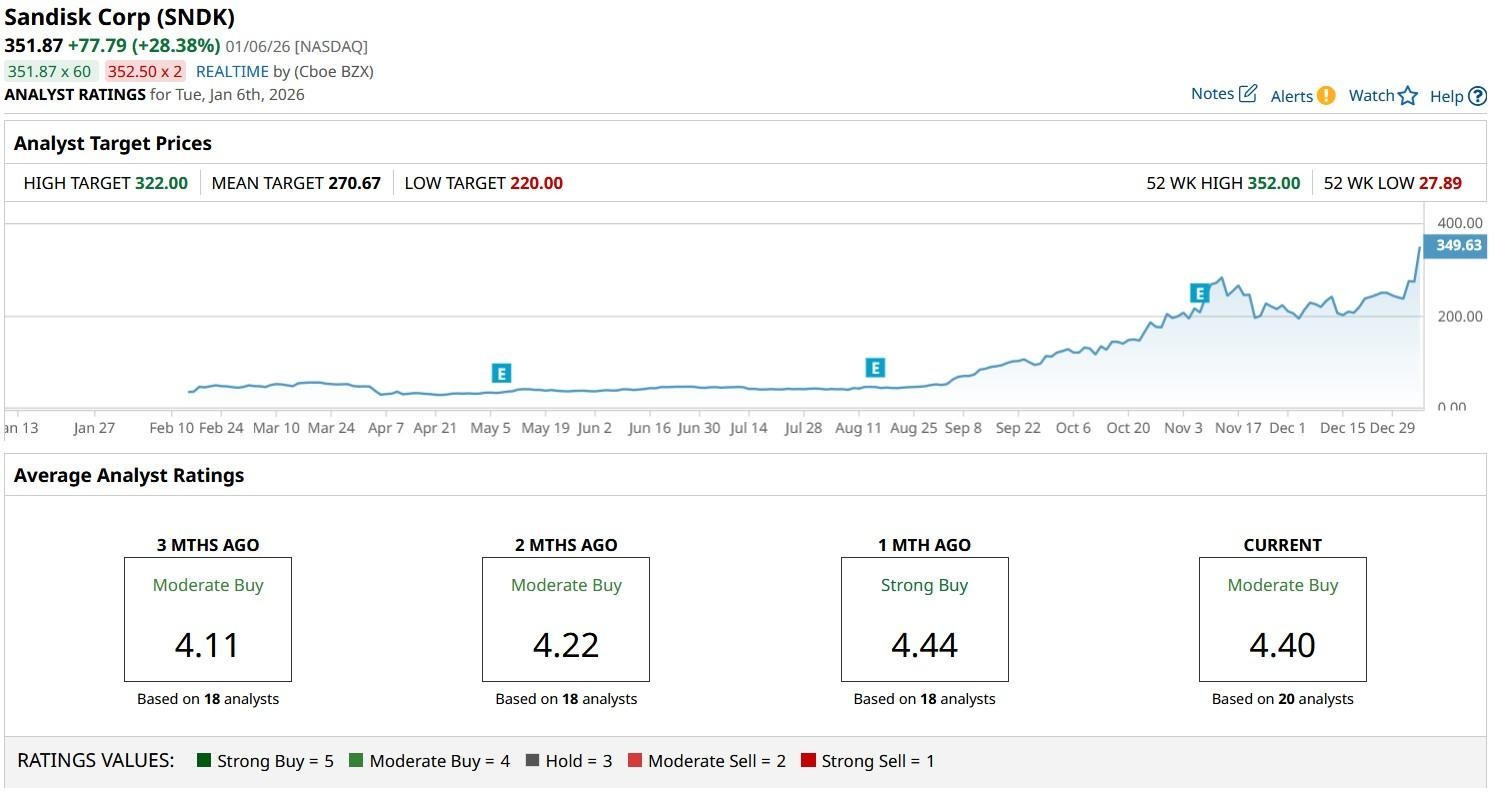

Including Tuesday’s surge, SanDisk stock is trading more than 10x above its 52-week low.

NAND Price Hikes to Drive SanDisk Stock Higher

According to Heidi Arkinstall, the company’s vice president of marketing, the “SanDisk Optimus™ brand redefines what performance means for consumer needs.”

SNDK stock remains attractive as a long-term holding also because industry leaders described the NAND supply crisis as an “unprecedented” shortage that will drive up prices at the CES 2026.

In fact, TrendForce now sees NAND flash prices increasing by as much as 38% in the first quarter.

What it means is SanDisk could come in ahead of the consensus estimate as it posts its quarterly earnings on Jan. 29, which may prove a near-term catalyst that drives this chip stock to new highs.

SNDK Shares Remain Attractively Valued in 2026

SanDisk has had a meteoric run over the past nine months primarily because the company is widely seen as a key enabler of artificial intelligence (AI).

Still, it’s trading at a forward price-to-earnings (P/E) multiple of less than 21x currently, far below some of the other best-of-breed AI stocks like Nvidia (NVDA).

Combined with a 21% revenue growth (sequential) in its latest reported quarter, SNDK looks like a quintessential example of “growth at a reasonable price.”

More importantly, beyond the RSI, even technicals suggest continued momentum ahead. SanDisk shares are currently trading well above their major moving averages (MAs), reinforcing that the broader trend remains upward.

Wall Street Recommends Caution in Playing SanDisk

Despite the aforementioned positives, Wall Street analysts seem to believe SanDisk’s stock price rally has indeed gone a bit too far and a correction in the near term may be healthy.

While the consensus rating on SNDK shares remains at “Moderate Buy,” their mean price target of about $271 actually suggests potential downside of more than 22% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Stock Is Breaking Below Key Support Ahead of Q4 Earnings. Should You Buy the Dip or Stay Far Away?

- SanDisk Stock Just Became Overbought After 20% Surge in SNDK. How Should You Play the Top S&P 500 Name Here?

- Should You Chase the Rally in Alumis Stock Today?

- Dear Oklo Stock Fans, Mark Your Calendars for January 7