While Gen Z (born between 1997 and 2009) is under a constant microscope as the next generation to shape the economy, Gen Alpha – those born in 2010 or later - is rapidly forming their spending and saving habits, according to new data from USAA Federal Savings Bank.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260113947016/en/

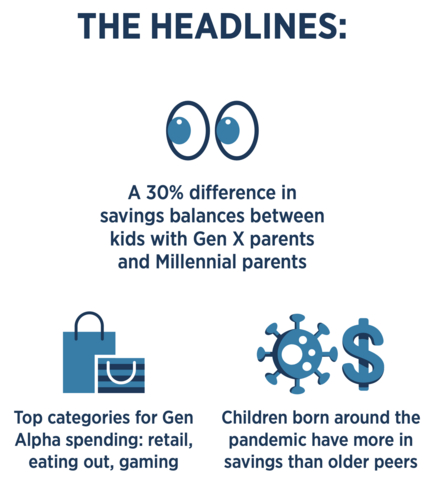

In examining Gen Alpha’s money habits, this analysis of aggregated data from over 579,000 USAA Bank Youth Checking and Savings accounts also revealed the generational influence that parents may have. Particularly, kids with Gen X parents had 30% higher average savings account balances and dipped into savings a third less often than Millennial-parented peers. This 30% difference is despite the typical deposit at account opening being nearly identical for both sets of children.

Conversely, the digital familiarity of Millennials may trickle down into their kids’ app usage. The analysis showed that CashApp, Zelle® and other P2P payment app usage among kids with Millennial parents was twice as high as those with Gen X parents, both in terms of percentage of overall spend and volume. With kids having access to spending – and even earning – money via mobile devices at a younger age, Gen Alpha stands to shape economic trends and their own financial well-being earlier than any previous generation.

“Helping children start on a strong financial footing is impactful for the long-term wellbeing of our members and their families,” said Michael Moran, President, USAA Federal Savings Bank. “Our data shows that Gen Alpha is forming their financial habits from an earlier age, with digital commerce available to them like no previous generation. While each parental generation will impart their own wisdom and nuance, instilling the basics of spending and saving at a younger age becomes even more important.”

GenAlpha Savings Trends: A Head Start

In examining Gen Alpha account balances by birth year, the data showed that younger children – especially those born in or around 2020 – have balances that are 6-9% above the Gen Alpha average, higher than generational peers. Some of this may be due to parents having funneled pandemic-era stimulus into their kids’ savings, mirroring a trend among adult savings accounts in 2020-21. That said, younger children tend to be in the ‘savings’ phase of the youth financial lifecycle, with fewer opportunities to spend and activity directed primarily by parents.

While the teen/pre-teen Gen Alphas have savings balances that are 2-5% below the generational average, they are also entering a more active spending phase of the lifecycle. The savings difference between older and younger Gen Alphas is marginal, highlighting some saving alongside spending.

How Is Gen Alpha Spending Their Money?

Some trends, such as spending more on eating out, shopping and games, were timeless. Looking at purchases and payments, Gen Alpha children are spending their money on retail, dining and gaming platforms. Where the money goes – and how much of it goes where – differs only slightly between children with Gen X and Millennial parents. Shopping is king, with three major online and brick-and-mortar retailers accounting for 10% or more of all spend.

Given that the oldest Gen Alphas are now reaching the age where part-time work is possible, it comes as no surprise that the Bank of Mom and Dad are still the biggest funders. About 70% of incoming transactions, by value, into youth checking accounts were from a USAA or other bank account. That said, 15% came from payroll deposits.

Building a Solid Foundation

Helping kids learn to save and spend wisely sets the stage for lifelong financial success. Parents play a critical role by modeling good habits and providing tools that make money management simple and engaging.

USAA provides extensive advice on youth saving, spending and banking for success. Here are some tips for parents and kids:

- Start early: Use games, toy banks, and counting exercises to teach younger children the basics of money. For older kids, help them manage allowances and cash gifts.

- Make saving visual: Use clear jars or progress charts so kids can see their savings grow toward a goal.

- Introduce budgeting: Teach older kids and teens to divide money into “save, spend, and give” buckets or use a simple 50/30/20 rule, mirroring the recommended “needs, wants, and savings” ratio for adults.

- Practice real-world banking: Open youth accounts with parental controls to help teens manage allowances or paychecks responsibly.

Notes to Editors

Methodology

This analysis was derived from aggregated and anonymized account and transaction data from over 579,000 USAA Bank Youth Checking and Savings accounts belonging to USAA members born between August 31, 2010 and August 31, 2025. Account balances were as of August 31, 2025. Annual transaction and payment data reflects the period of September 1, 2024 through August 31, 2025.

About USAA

Founded in 1922 by a group of military officers, USAA is among the leading providers of insurance, banking and retirement solutions and serves more than 14 million members of the U.S. military, veterans who have honorably served and their families. Headquartered in San Antonio, USAA has offices in eight U.S. cities and three overseas locations and employs more than 38,000 people worldwide. Each year, the company contributes to national and local nonprofits in support of military families and communities where employees live and work. For more information about USAA, follow us on Facebook or X (@usaa), or visit usaa.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260113947016/en/

Kids with Gen X parents had 30% higher average savings account balances and dipped into savings a third less often than Millennial-parented peers.

Contacts

USAA PR Team

external_communications@usaa.com