Whether or not the FOMC raises interest rates again this year is meaningless in the grand picture. As uncertain as the next move is, interest rates will certainly be high for a long time. The only thing that can alter that outlook is a hard landing, which raises the question of whether a soft landing is bad for the economy. A soft landing is when monetary policy is adjusted at just the right times to ensure inflation is tamed and the economy can stabilize without a serious recession.

Stabilizing without a serious recession is the problem. Given the evidence today, a soft landing will result in sustained inflation and possibly accelerating inflation that keeps the Fed’s foot on the brakes longer than currently expected. As it is, the market shifted the outlook for peak rates and the first interest rate cuts 9 months further out than expected earlier this year. Because inflation remains hot and the underlying causes are still in place, the outlook for peak rates and the first rate cut will likely move beyond mid-summer 2024 and potentially into 2025.

Job Growth and Wages Drive Consumer Demand

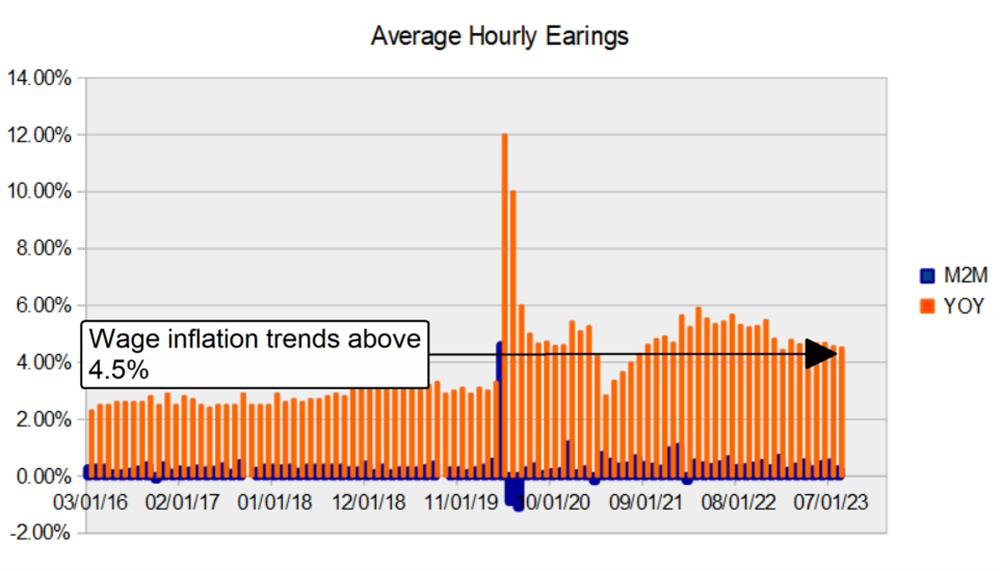

The labor market data is mixed this year. The data shows some degradation from the previous year, but this is not a red flag. The previous year was still peak-rebound regarding the labor market, and the comps are tough. One measure of the market that bears watching is the Total Jobless Claims figure, which suggests labor market normalization is at hand.

Total claims are up 26% YOY, but last year’s figure was an historic low for the period, and the comp versus 2021 and 2020 is -66% and -93%, quite an improvement from the pandemic highs. More importantly, claims are up a mere 17% compared to 2019 and consistent with the recovery period leading up to the pandemic era, as is most other labor market data.

Likewise, the job creation data has soured compared to last year but remains consistent with the pre-pandemic period. Job creation is robust enough to sustain wage inflation near 4.5%, which is the problem. Job creation is not expected to founder, although there are some shifts in the workforce. The next few months may see total claims tick higher, but this is seasonally expected. The takeaway is that job and wage growth fuel consumer habits and demand-side inflation; a soft landing will allow this situation to persist, giving the FOMC no room to cut rates.

Oil Prices are the Elephant in the Room

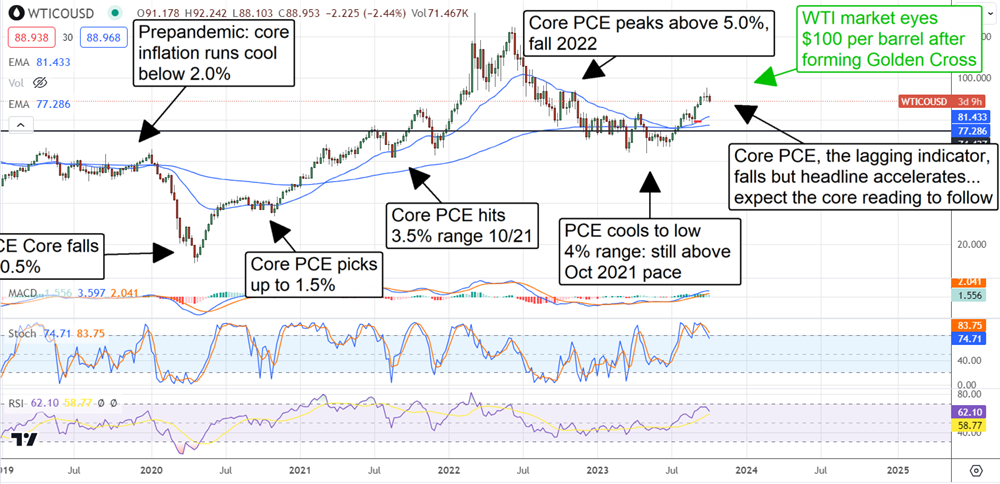

Inflation might be tamed if not for oil prices. Oil prices are a compounding influence on prices throughout the economic system, and they are rising. The higher oil prices stay for longer, the more the impact and OPEC+ Russia will keep the oil market trending higher. Together, they have global production lagging demand by roughly 1 million barrels per day, which is expected to remain true through the end of the year. Western producers are ramping, but each time they make gains, OPEC+ is there to offset it.

The point is that a soft landing will do nothing to undermine oil demand. If anything, demand will stabilize and provide another tailwind for the oil market. The only way to curb oil demand now is to cause a hard landing and reset the market.

There is a clear correlation between WTI and inflation, and now WTI is trading at levels that should be expected to sustain inflation at current levels if not accelerate. The charts alone suggest a move to $100 is possible. The next inflation is due October 13th, the CPI report and it is expected to show acceleration at the headline and core level. The next FOMC meeting is the 1st of November. The next OPEC meeting is also expected in November, so the late fall could be volatile for markets.