Looking back on beverages, alcohol and tobacco stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Constellation Brands (NYSE: STZ) and its peers.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 14 beverages, alcohol and tobacco stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was 2.7% below.

In light of this news, share prices of the companies have held steady as they are up 1.1% on average since the latest earnings results.

Constellation Brands (NYSE: STZ)

With a presence in more than 100 countries, Constellation Brands (NYSE: STZ) is a globally renowned producer and marketer of beer, wine, and spirits.

Constellation Brands reported revenues of $2.92 billion, up 2.9% year on year. This print fell short of analysts’ expectations by 0.7%, but it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ organic revenue estimates.

Unsurprisingly, the stock is down 7.1% since reporting and currently trades at $237.53.

Is now the time to buy Constellation Brands? Access our full analysis of the earnings results here, it’s free.

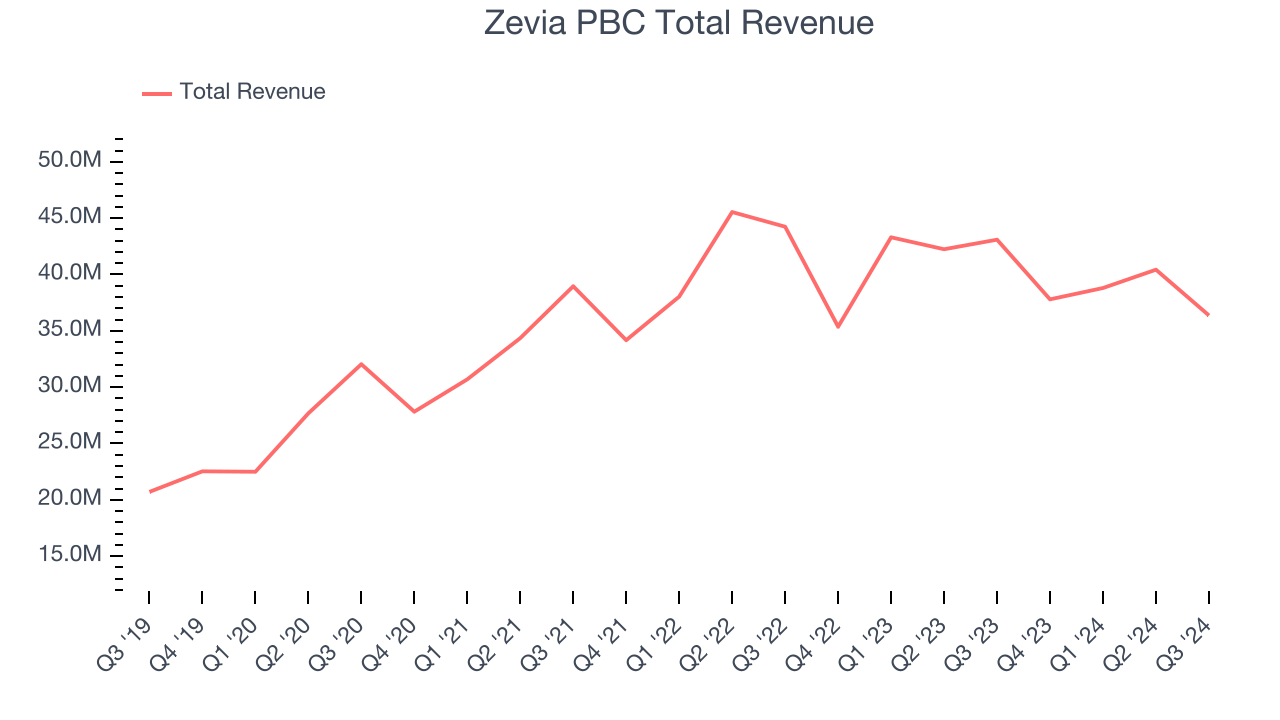

Best Q3: Zevia PBC (NYSE: ZVIA)

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE: ZVIA) is a better-for-you beverage company.

Zevia PBC reported revenues of $36.37 million, down 15.6% year on year, falling short of analysts’ expectations by 6.8%. However, the business still had a strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 78.8% since reporting. It currently trades at $1.94.

Is now the time to buy Zevia PBC? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Celsius (NASDAQ: CELH)

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ: CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $265.7 million, down 30.9% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Celsius delivered the slowest revenue growth in the group. As expected, the stock is down 18.3% since the results and currently trades at $25.95.

Read our full analysis of Celsius’s results here.

PepsiCo (NASDAQ: PEP)

With a history that goes back more than a century, PepsiCo (NASDAQ: PEP) is a household name in food and beverages today and best known for its flagship soda.

PepsiCo reported revenues of $23.32 billion, flat year on year. This print missed analysts’ expectations by 1.9%. It was a slower quarter as it also logged a miss of analysts’ organic revenue estimates and EBITDA in line with analysts’ estimates.

The stock is down 4.8% since reporting and currently trades at $159.22.

Read our full, actionable report on PepsiCo here, it’s free.

Anheuser-Busch (NYSE: BUD)

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE: BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch reported revenues of $15.05 billion, down 3.4% year on year. This result lagged analysts' expectations by 4.2%. It was a softer quarter as it also recorded a miss of analysts’ EBITDA estimates.

The stock is down 10.6% since reporting and currently trades at $56.26.

Read our full, actionable report on Anheuser-Busch here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.