ABM Industries has been treading water for the past six months, recording a small return of 4% while holding steady at $50.97. This is close to the S&P 500’s 4.7% gain during that period.

Is there a buying opportunity in ABM Industries, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're sitting this one out for now. Here are three reasons why we avoid ABM and a stock we'd rather own.

Why Do We Think ABM Industries Will Underperform?

Started with a $4.50 investment to purchase a bucket, sponge, and mop, ABM (NYSE: ABM) offers janitorial, parking, and facility services.

1. Slow Organic Growth Suggests Waning Demand In Core Business

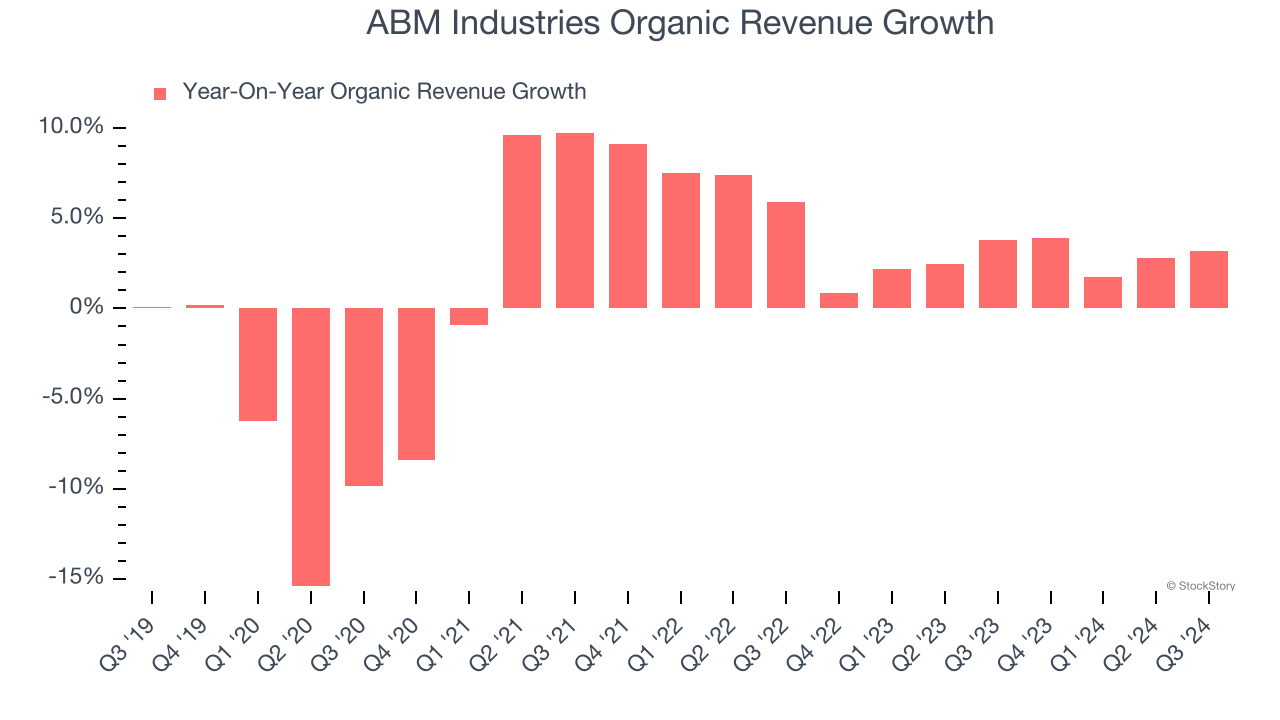

We can better understand Facility Services companies by analyzing their organic revenue. This metric gives visibility into ABM Industries’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, ABM Industries’s organic revenue averaged 2.6% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. EPS Took a Dip Over the Last Two Years

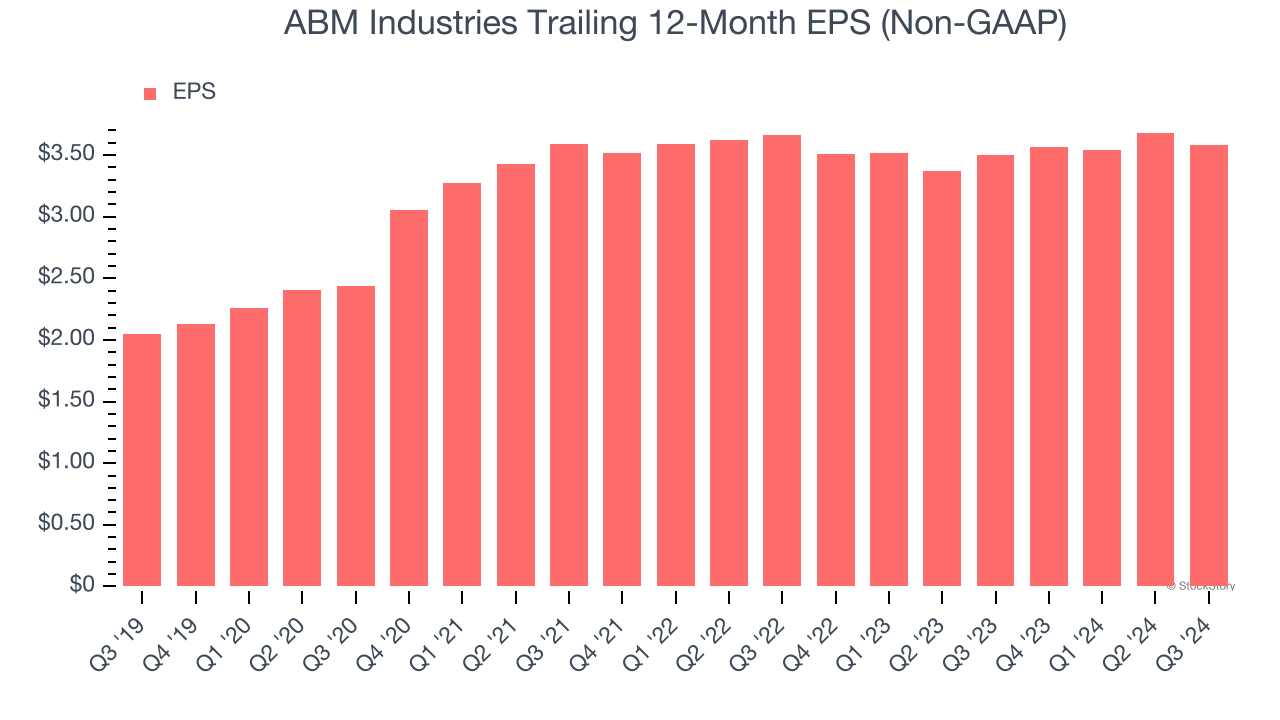

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for ABM Industries, its EPS declined by 1.1% annually over the last two years while its revenue grew by 3.5%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

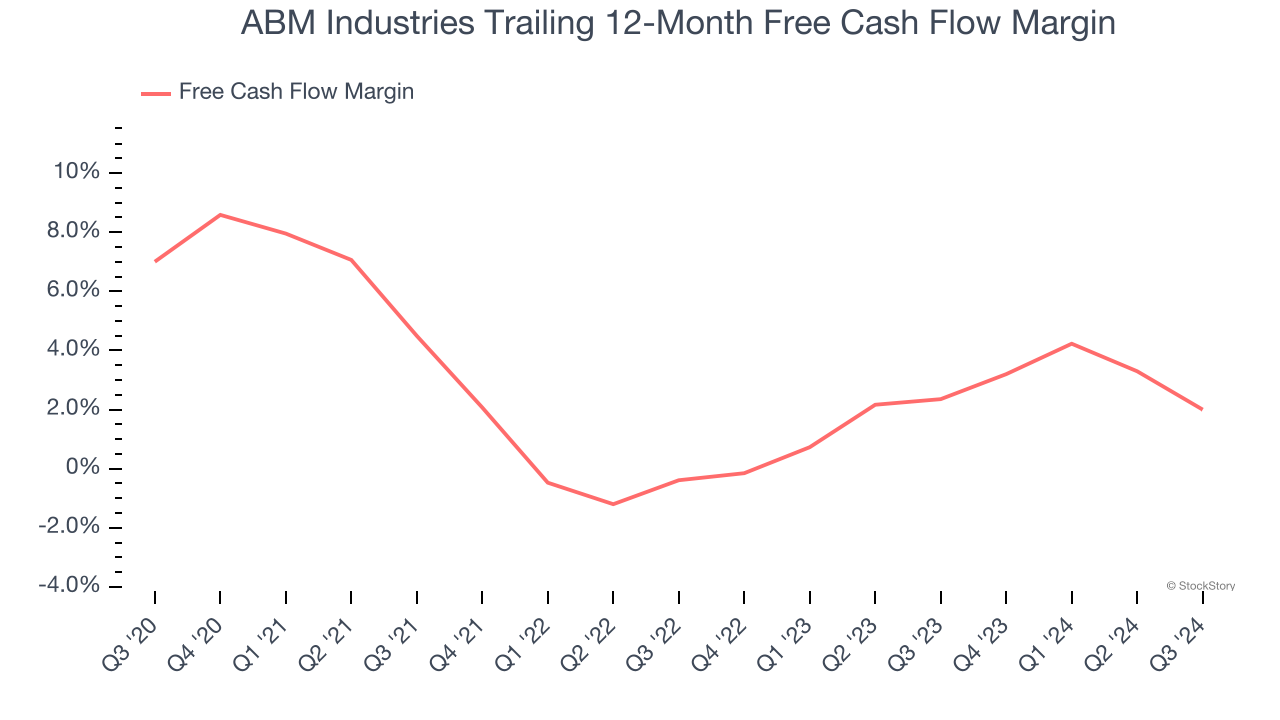

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, ABM Industries’s margin dropped by 5 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. ABM Industries’s free cash flow margin for the trailing 12 months was 2%.

Final Judgment

We see the value of companies helping their customers, but in the case of ABM Industries, we’re out. That said, the stock currently trades at 13.9× forward price-to-earnings (or $50.97 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now. We’d recommend looking at Microsoft, the most dominant software business in the world.

Stocks We Would Buy Instead of ABM Industries

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.