Dycom has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 10.3% to $191.32 per share while the index has gained 12.6%.

Is now the time to buy DY? Find out in our full research report, it’s free.

Why Does Dycom Spark Debate?

Working alongside some of the most popular mobile carriers in the world, Dycom (NYSE: DY) builds and maintains telecommunications infrastructure.

Two Things to Like:

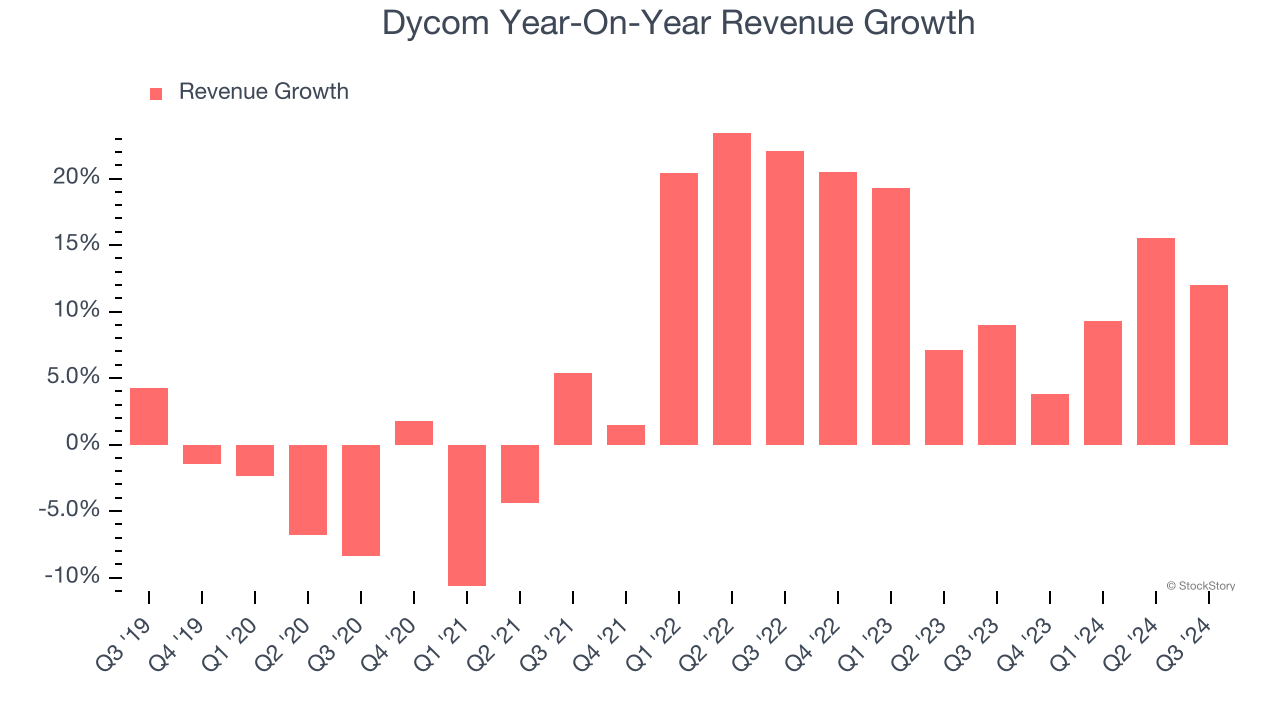

1. Skyrocketing Revenue Shows Strong Momentum

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Dycom’s annualized revenue growth of 11.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

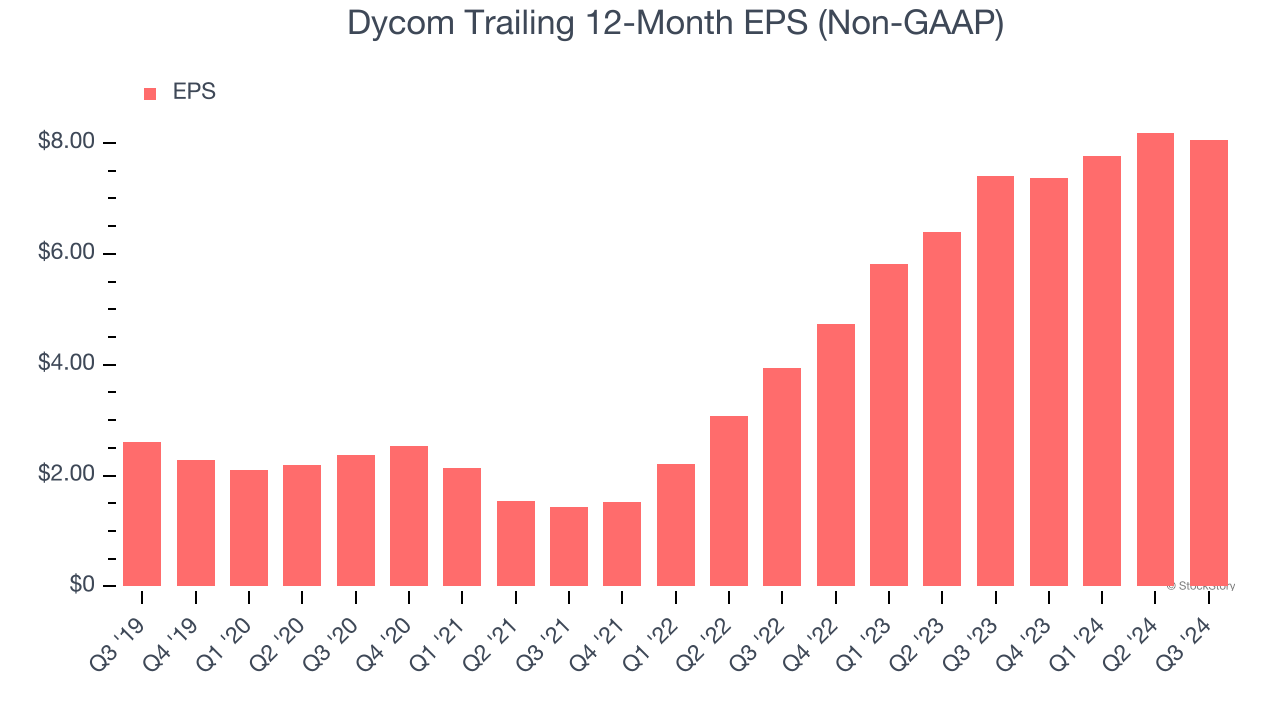

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Dycom’s EPS grew at an astounding 25.3% compounded annual growth rate over the last five years, higher than its 6.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

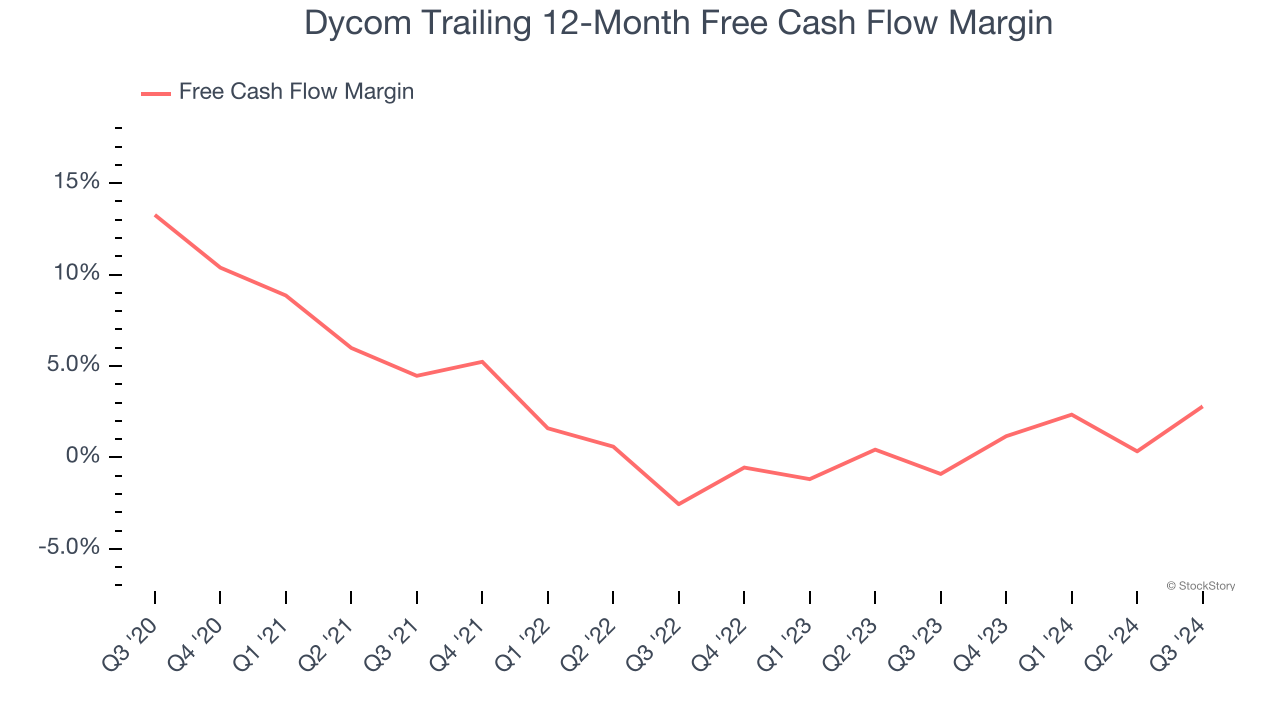

Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Dycom’s margin dropped by 10.5 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Dycom’s free cash flow margin for the trailing 12 months was 2.8%.

Final Judgment

Dycom has huge potential even though it has some open questions, but at $191.32 per share (or 20.9× forward price-to-earnings), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Dycom

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.