Data collaboration platform LiveRamp (NYSE: RAMP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 7.7% year on year to $199.8 million. The company expects next quarter’s revenue to be around $211 million, close to analysts’ estimates. Its non-GAAP profit of $0.55 per share was 13.6% above analysts’ consensus estimates.

Is now the time to buy LiveRamp? Find out by accessing our full research report, it’s free for active Edge members.

LiveRamp (RAMP) Q3 CY2025 Highlights:

- Revenue: $199.8 million vs analyst estimates of $197.8 million (7.7% year-on-year growth, 1% beat)

- Adjusted EPS: $0.55 vs analyst estimates of $0.48 (13.6% beat)

- Adjusted Operating Income: $44.7 million vs analyst estimates of $39.21 million (22.4% margin, 14% beat)

- The company slightly lifted its revenue guidance for the full year to $811 million at the midpoint from $808 million

- Operating Margin: 10.7%, up from 4% in the same quarter last year

- Free Cash Flow was $56.82 million, up from -$16 million in the previous quarter

- Customers: 834

- Net Revenue Retention Rate: 105%, in line with the previous quarter

- Annual Recurring Revenue: $516 million vs analyst estimates of $510.1 million (6.8% year-on-year growth, 1.2% beat)

- Market Capitalization: $1.77 billion

Company Overview

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE: RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

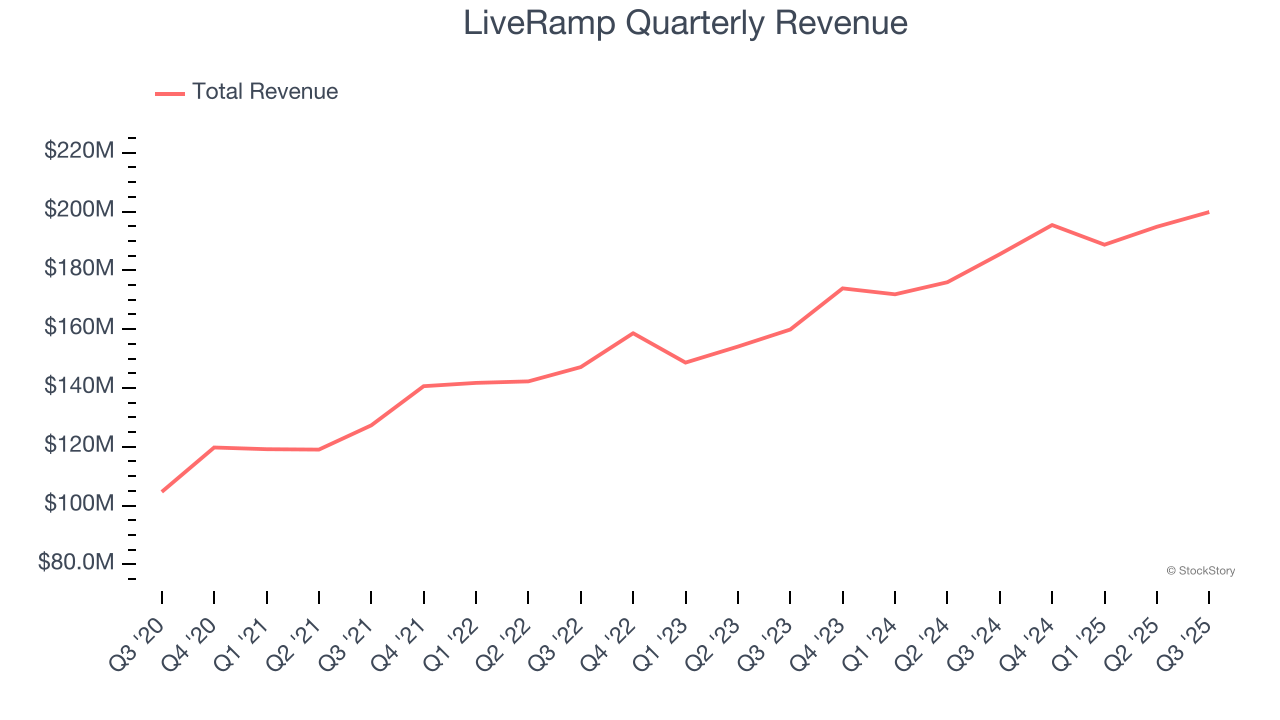

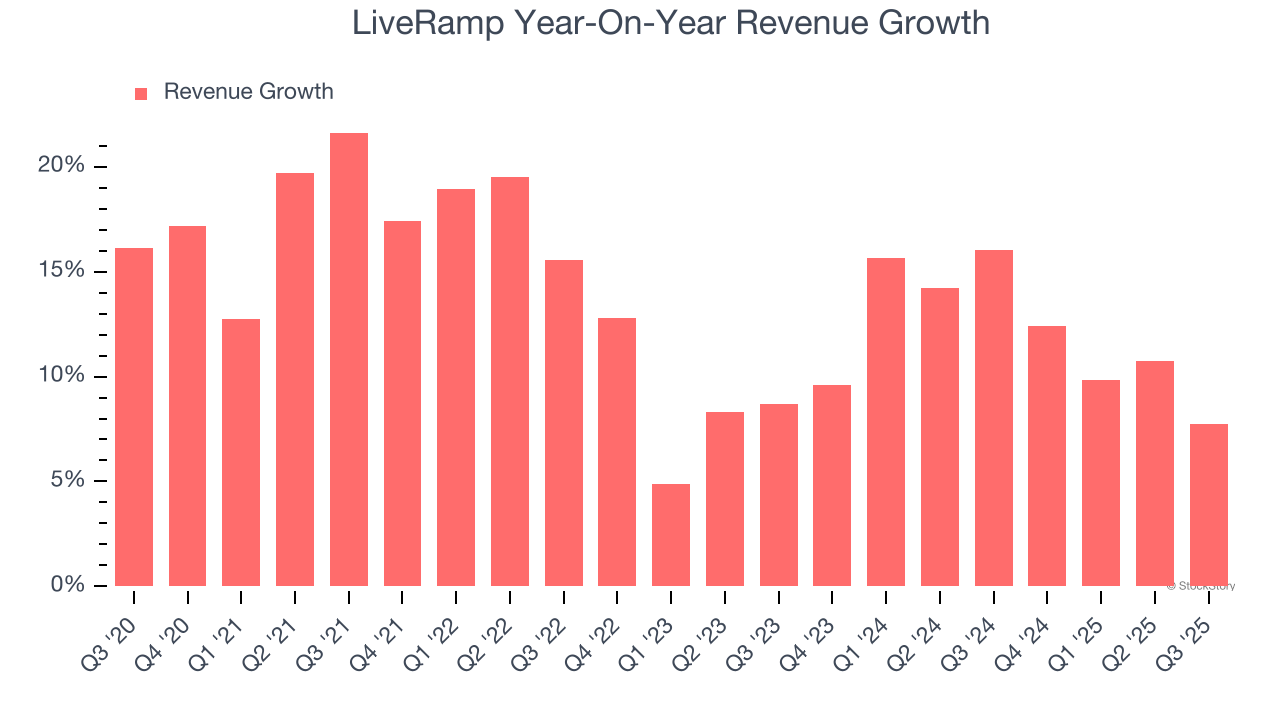

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, LiveRamp grew its sales at a 13.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. LiveRamp’s recent performance shows its demand has slowed as its annualized revenue growth of 12% over the last two years was below its five-year trend.

This quarter, LiveRamp reported year-on-year revenue growth of 7.7%, and its $199.8 million of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

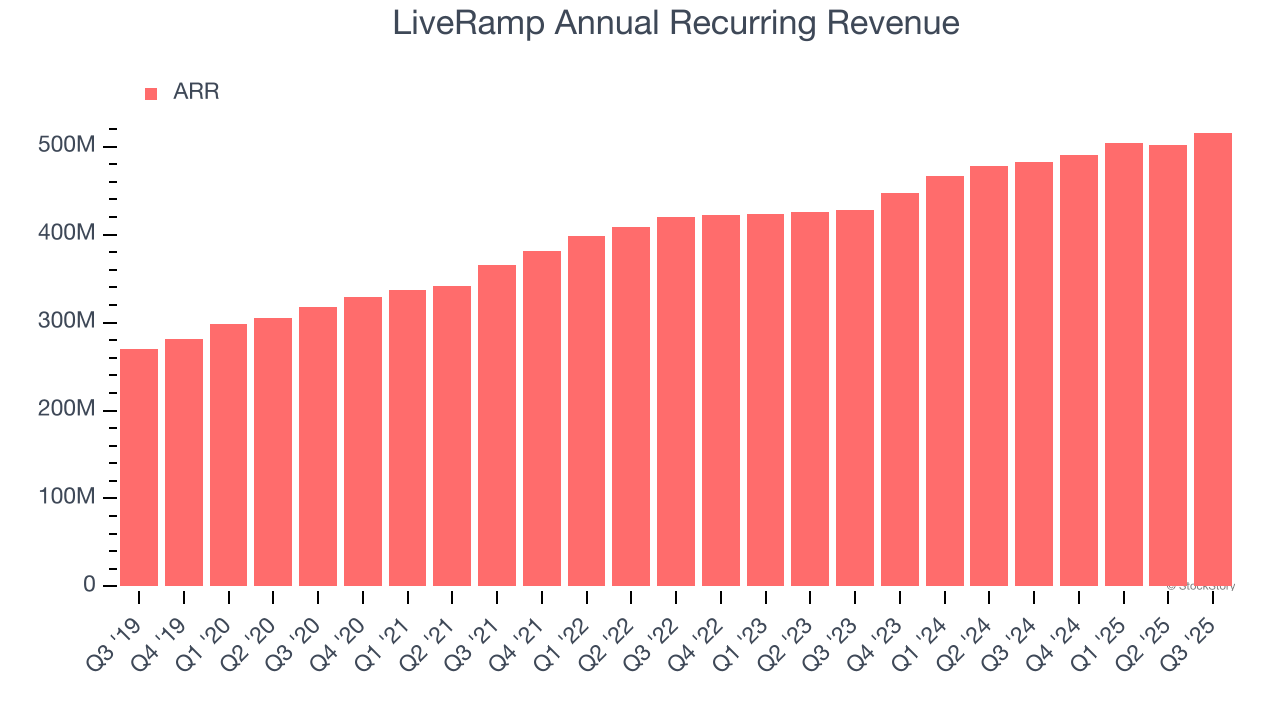

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

LiveRamp’s ARR came in at $516 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 7.4% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

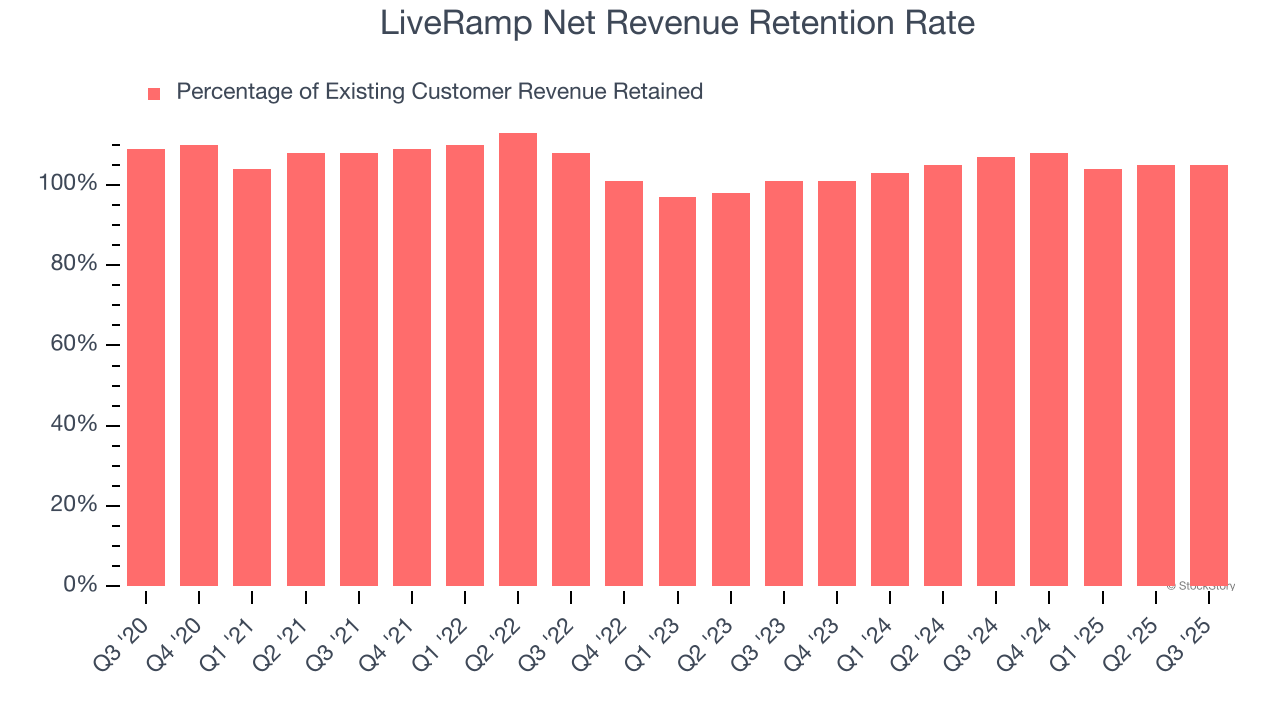

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

LiveRamp’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 106% in Q3. This means LiveRamp would’ve grown its revenue by 5.5% even if it didn’t win any new customers over the last 12 months.

LiveRamp has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from LiveRamp’s Q3 Results

It was good to see LiveRamp narrowly top analysts’ annual recurring revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Operating profit outperformed by a more convincing amount. Overall, this quarter was solid. The stock traded up 2.1% to $28.01 immediately following the results.

So do we think LiveRamp is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.