Cloud contact center software provider Five9 (NASDAQ: FIVN) met Wall Streets revenue expectations in Q3 CY2025, with sales up 8.2% year on year to $285.8 million. On the other hand, next quarter’s revenue guidance of $297.7 million was less impressive, coming in 0.8% below analysts’ estimates. Its non-GAAP profit of $0.78 per share was 6.5% above analysts’ consensus estimates.

Is now the time to buy Five9? Find out by accessing our full research report, it’s free for active Edge members.

Five9 (FIVN) Q3 CY2025 Highlights:

- Revenue: $285.8 million vs analyst estimates of $285.2 million (8.2% year-on-year growth, in line)

- Adjusted EPS: $0.78 vs analyst estimates of $0.73 (6.5% beat)

- Adjusted Operating Income: $57.11 million vs analyst estimates of $52.72 million (20% margin, 8.3% beat)

- Revenue Guidance for Q4 CY2025 is $297.7 million at the midpoint, below analyst estimates of $300.2 million

- Management raised its full-year Adjusted EPS guidance to $2.94 at the midpoint, a 2.1% increase

- Operating Margin: 5.6%, up from -5.8% in the same quarter last year

- Free Cash Flow Margin: 13.4%, up from 7.6% in the previous quarter

- Billings: $293.8 million at quarter end, up 5.4% year on year

- Market Capitalization: $1.76 billion

Company Overview

Taking its name from the "five nines" (99.999%) standard for optimal service reliability in telecommunications, Five9 (NASDAQ: FIVN) provides cloud-based software that enables businesses to run their contact centers with tools for customer service, sales, and marketing across multiple communication channels.

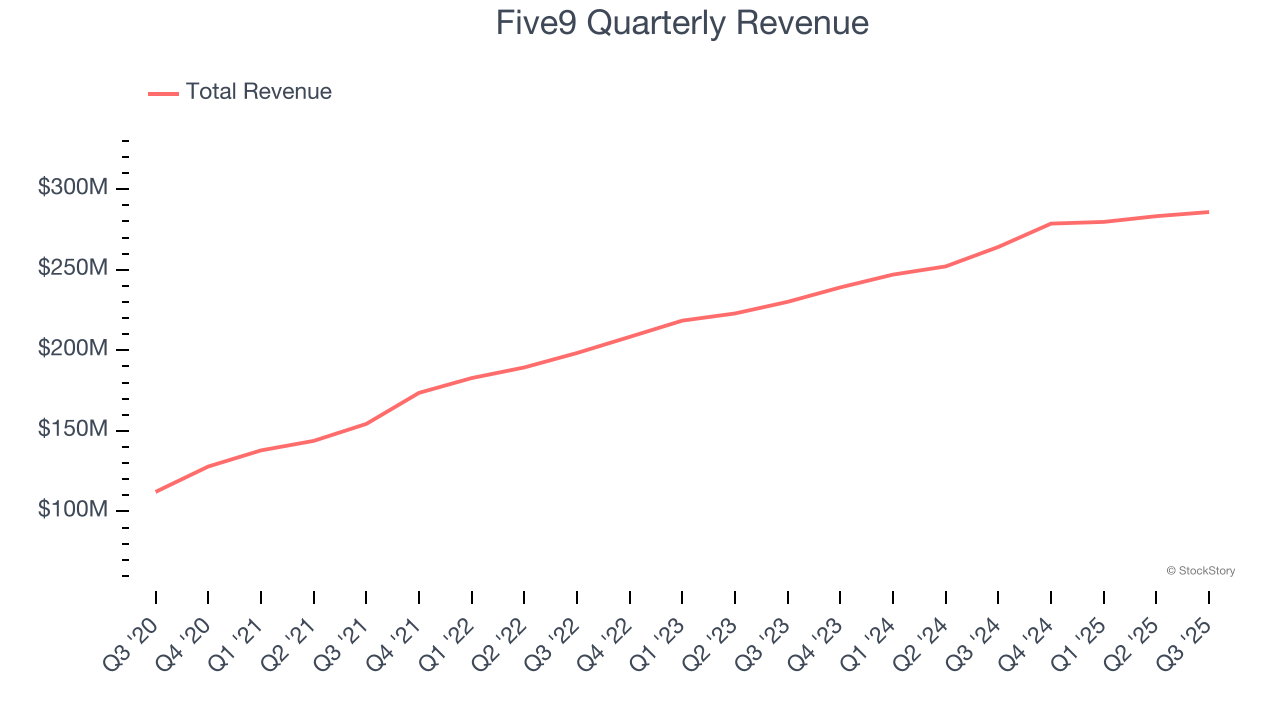

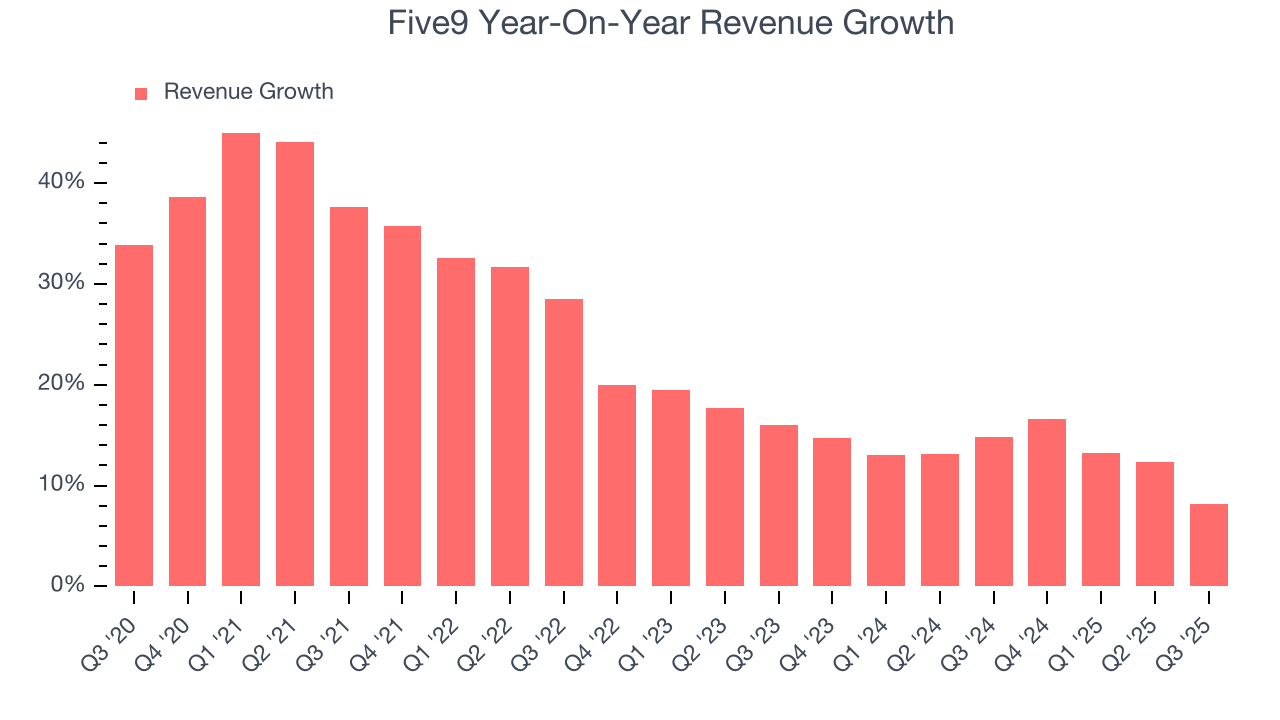

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Five9’s sales grew at a solid 23.1% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Five9’s recent performance shows its demand has slowed as its annualized revenue growth of 13.2% over the last two years was below its five-year trend.

This quarter, Five9 grew its revenue by 8.2% year on year, and its $285.8 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

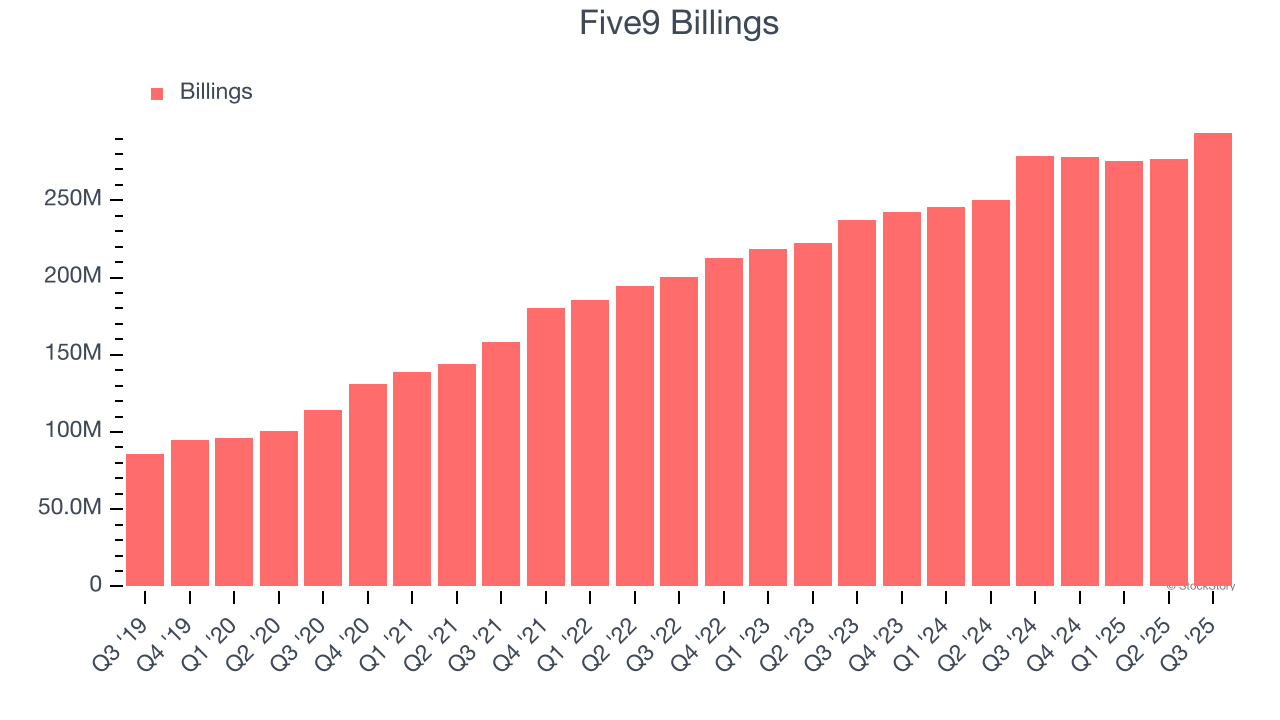

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Five9’s billings came in at $293.8 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 10.6% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Five9 to acquire new customers as its CAC payback period checked in at 175.3 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Five9’s Q3 Results

We were impressed by how significantly Five9 blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed and its billings fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 2.2% to $22 immediately following the results.

So do we think Five9 is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.