United Bankshares has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 8.5% to $39.54 per share while the index has gained 12.9%.

Is now the time to buy United Bankshares, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think United Bankshares Will Underperform?

We're swiping left on United Bankshares for now. Here are three reasons you should be careful with UBSI and a stock we'd rather own.

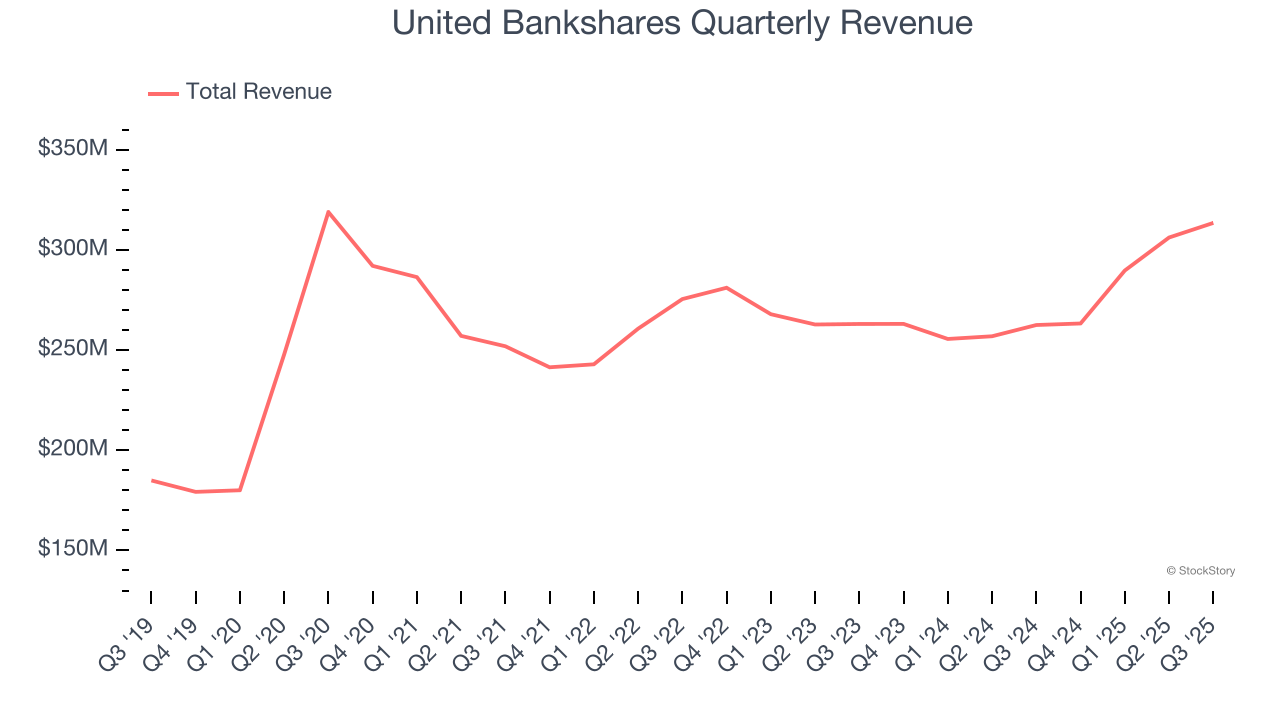

1. Long-Term Revenue Growth Disappoints

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Unfortunately, United Bankshares’s 4.8% annualized revenue growth over the last five years was sluggish. This was below our standard for the banking sector.

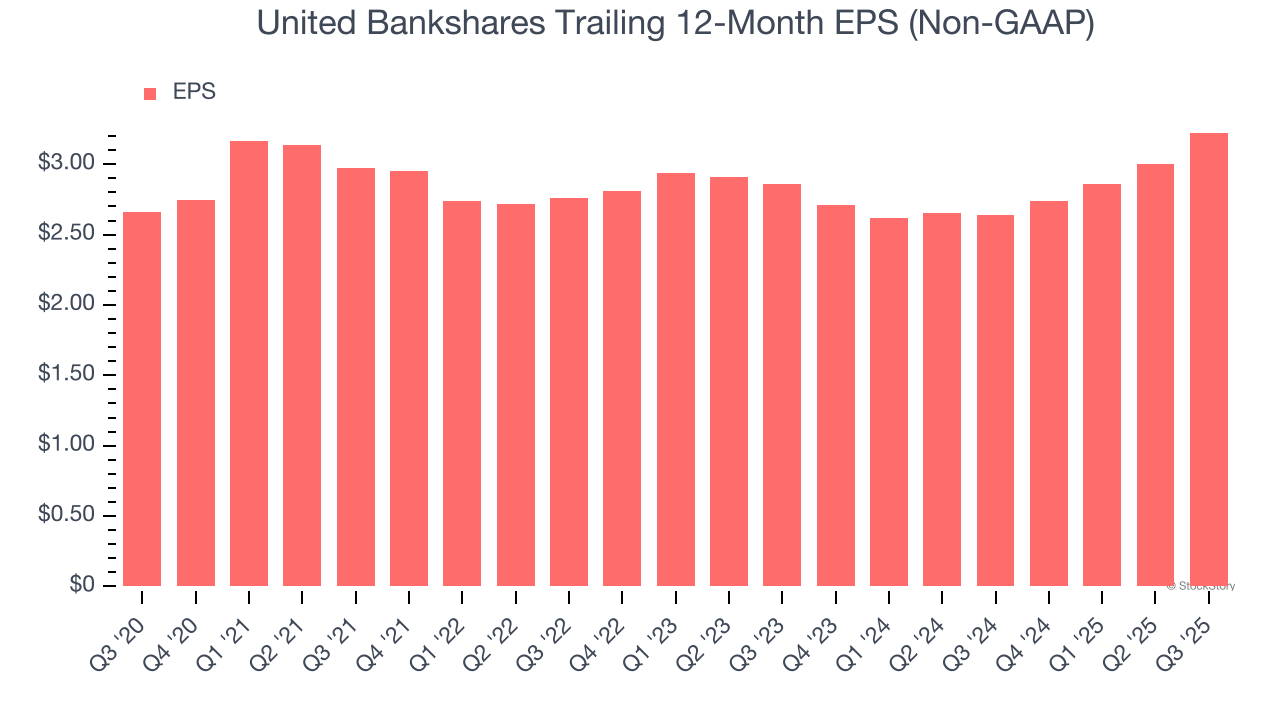

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

United Bankshares’s weak 3.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

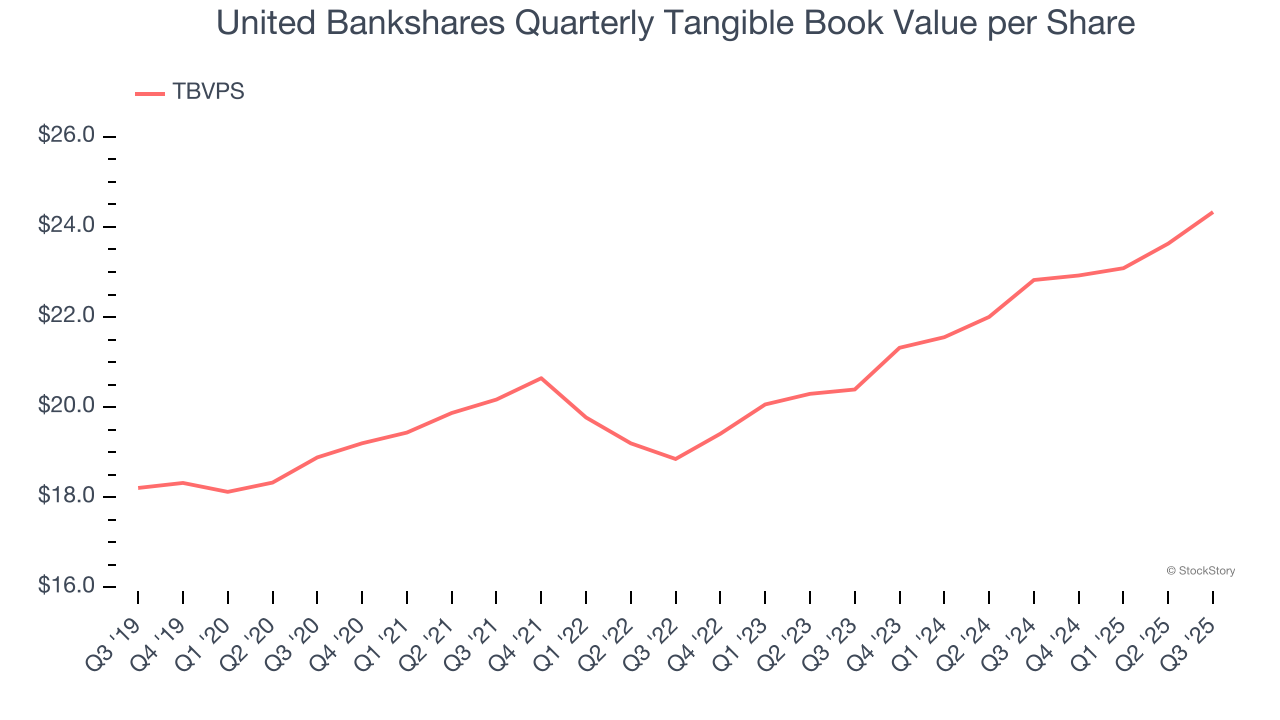

3. Projected TBVPS Growth Is Slim

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for United Bankshares’s TBVPS to grow by 6.2% to $25.84, lousy growth rate.

Final Judgment

We see the value of companies driving economic growth, but in the case of United Bankshares, we’re out. That said, the stock currently trades at 1× forward P/B (or $39.54 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of United Bankshares

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.