Looking back on online retail stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Carvana (NYSE: CVNA) and its peers.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

The 5 online retail stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 1.2% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.2% since the latest earnings results.

Best Q4: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

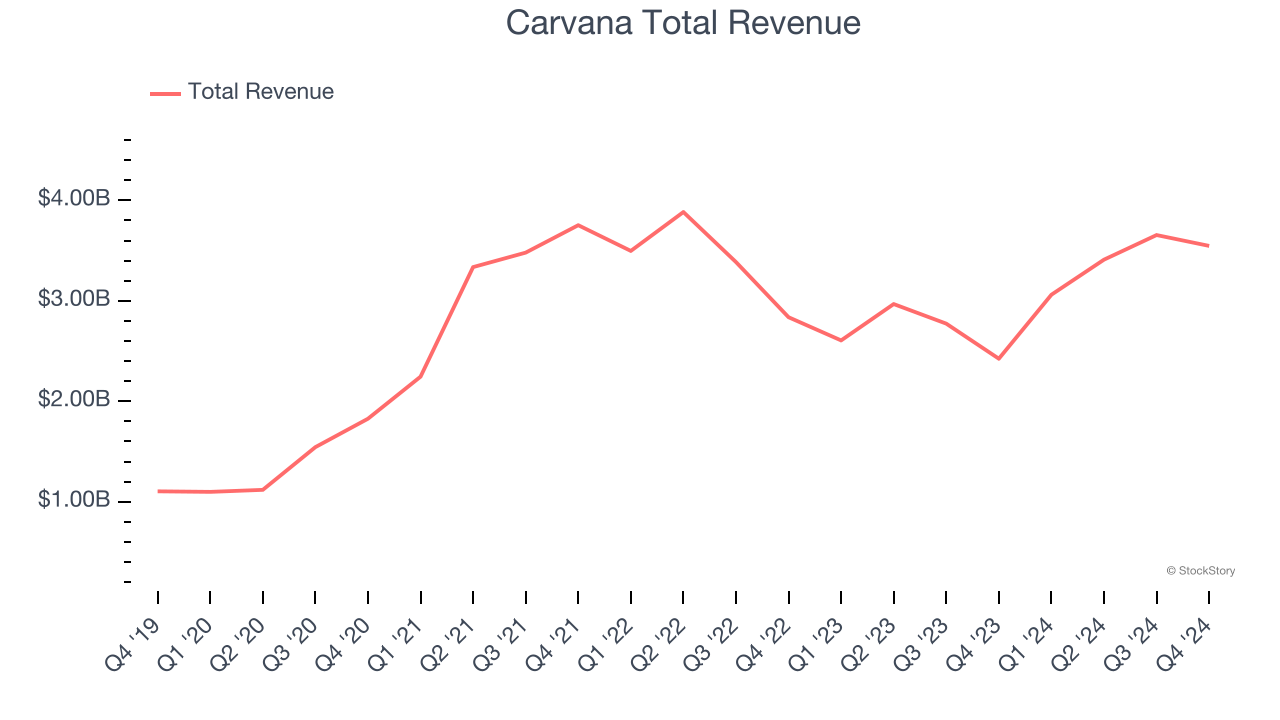

Carvana reported revenues of $3.55 billion, up 46.3% year on year. This print exceeded analysts’ expectations by 6.2%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and impressive growth in its units.

Carvana pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. The company reported 114,379 units sold, up 50.3% year on year. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 16.8% since reporting and currently trades at $234.40.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Revolve (NYSE: RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ: RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

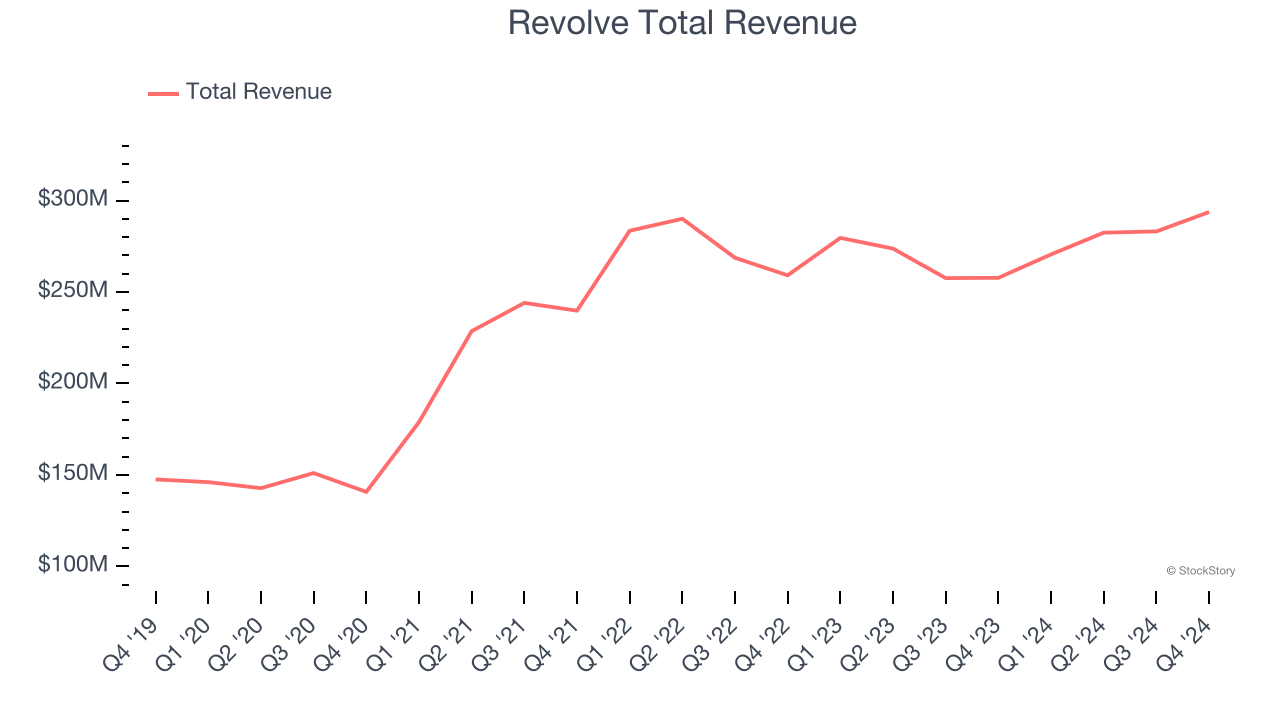

Revolve reported revenues of $293.7 million, up 13.9% year on year, outperforming analysts’ expectations by 3.8%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and number of active customers in line with analysts’ estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 5.1% since reporting. It currently trades at $26.89.

Is now the time to buy Revolve? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Wayfair (NYSE: W)

Founded in 2002 by Niraj Shah, Wayfair (NYSE: W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.12 billion, flat year on year, exceeding analysts’ expectations by 2%. Still, it was a softer quarter as it posted a significant miss of analysts’ number of active customers estimates.

Wayfair delivered the slowest revenue growth in the group. The company reported 21.4 million active buyers, down 4.5% year on year. As expected, the stock is down 8.4% since the results and currently trades at $42.44.

Read our full analysis of Wayfair’s results here.

Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $187.8 billion, up 10.5% year on year. This print was in line with analysts’ expectations. More broadly, it was a satisfactory quarter as it also logged a solid beat of analysts’ EPS estimates.

The stock is down 9.3% since reporting and currently trades at $216.50.

Read our full, actionable report on Amazon here, it’s free.

Coupang (NYSE: CPNG)

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE: CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Coupang reported revenues of $7.97 billion, up 21.4% year on year. This number missed analysts’ expectations by 1.3%. Overall, it was a mixed quarter for the company.

Coupang had the weakest performance against analyst estimates among its peers. The company reported 23.14 million active buyers, up 10.2% year on year. The stock is up 3.8% since reporting and currently trades at $25.06.

Read our full, actionable report on Coupang here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.