Building envelope solutions provider Carlisle Companies (NYSE: CSL) reported Q1 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.10 billion. Its non-GAAP profit of $3.61 per share was 5.6% above analysts’ consensus estimates.

Is now the time to buy Carlisle? Find out by accessing our full research report, it’s free.

Carlisle (CSL) Q1 CY2025 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.09 billion (flat year on year, 0.6% beat)

- Adjusted EPS: $3.61 vs analyst estimates of $3.42 (5.6% beat)

- Adjusted EBITDA: $238.4 million vs analyst estimates of $236 million (21.8% margin, 1% beat)

- Operating Margin: 16.8%, down from 20.5% in the same quarter last year

- Free Cash Flow was -$27.2 million, down from $132 million in the same quarter last year

- Organic Revenue fell 4.4% year on year (22.3% in the same quarter last year)

- Market Capitalization: $15.66 billion

Company Overview

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE: CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Sales Growth

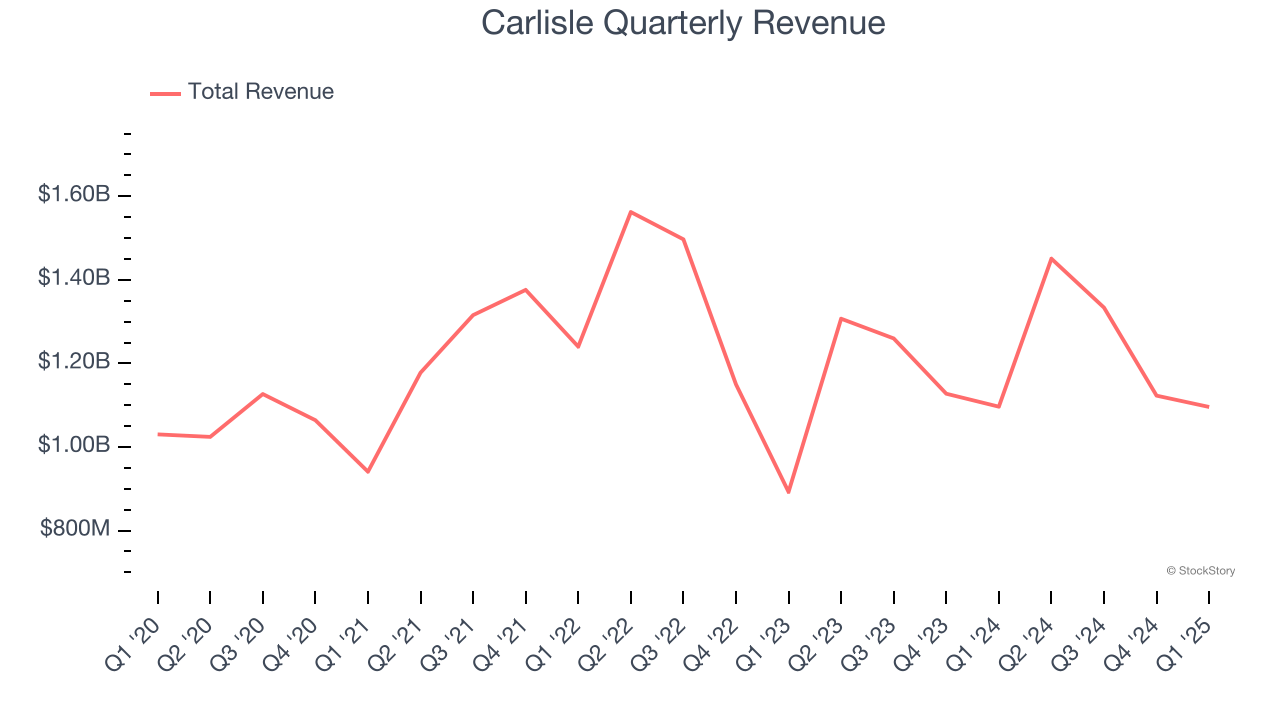

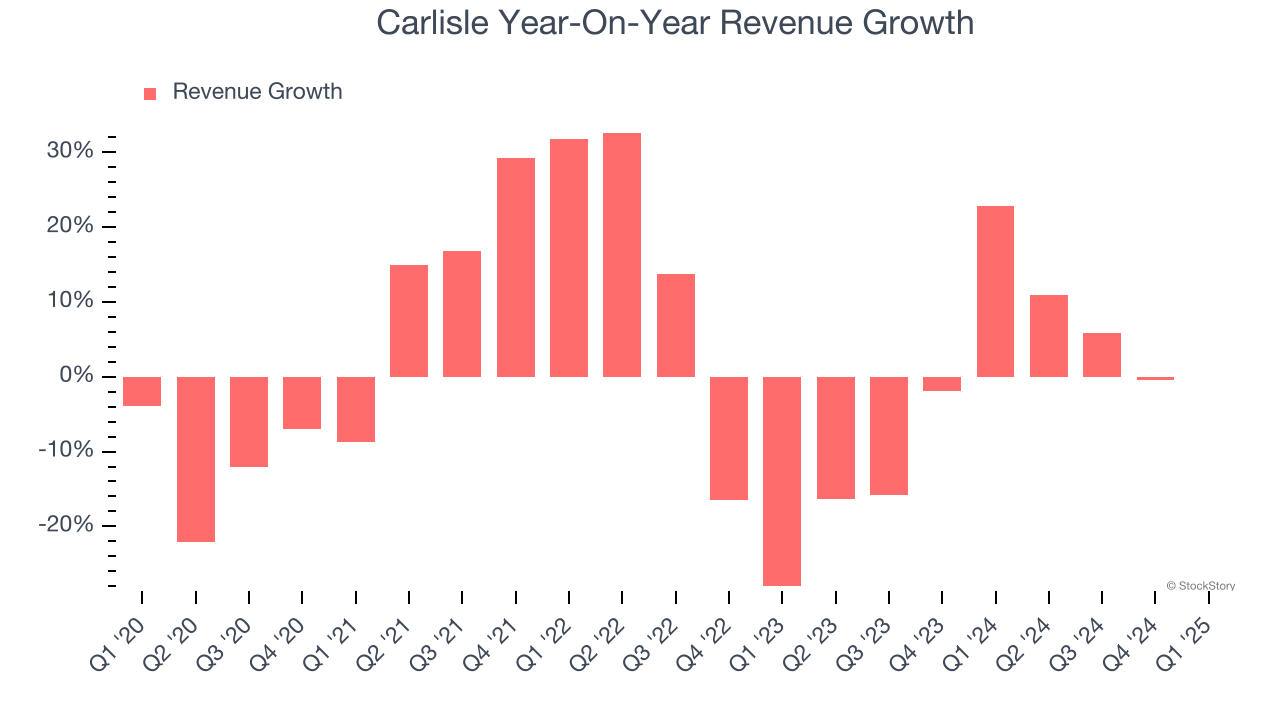

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Carlisle struggled to consistently increase demand as its $5.00 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Just like its five-year trend, Carlisle’s revenue over the last two years was flat, suggesting it is in a slump. We also note many other Building Materials businesses have faced declining sales because of cyclical headwinds. While Carlisle’s growth wasn’t the best, it did do better than its peers.

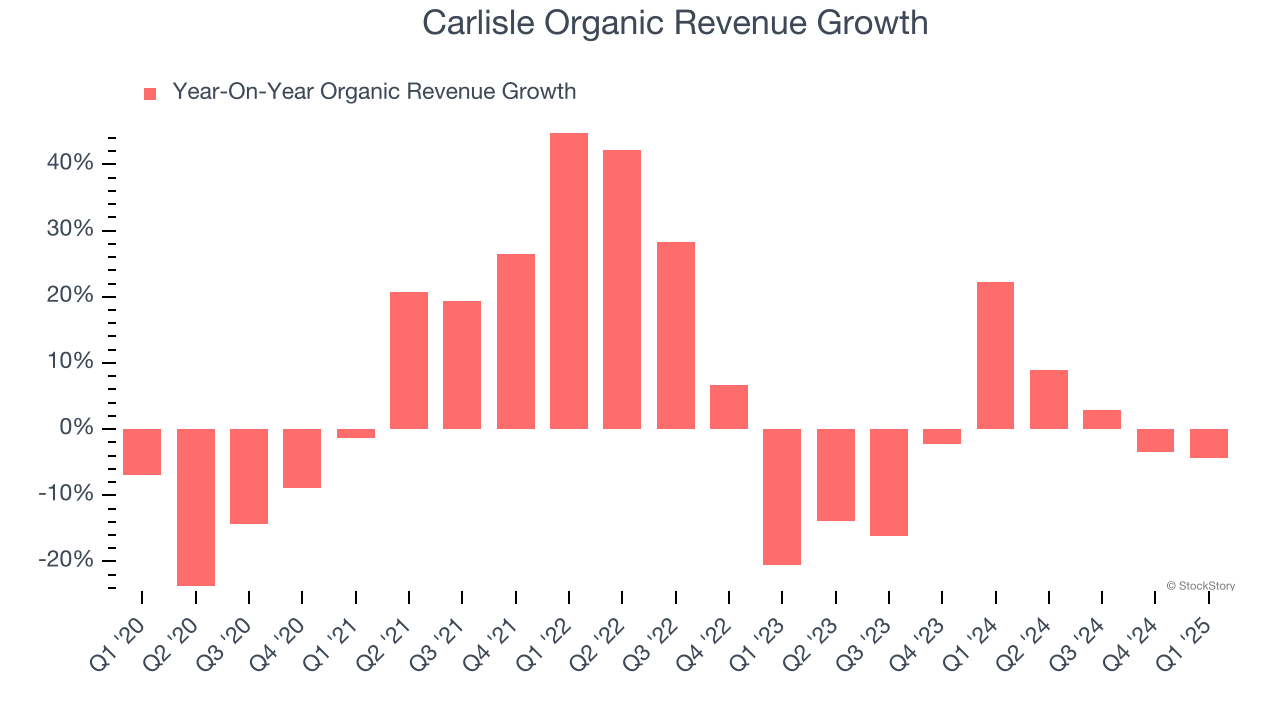

Carlisle also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Carlisle’s organic revenue was flat. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Carlisle’s $1.10 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

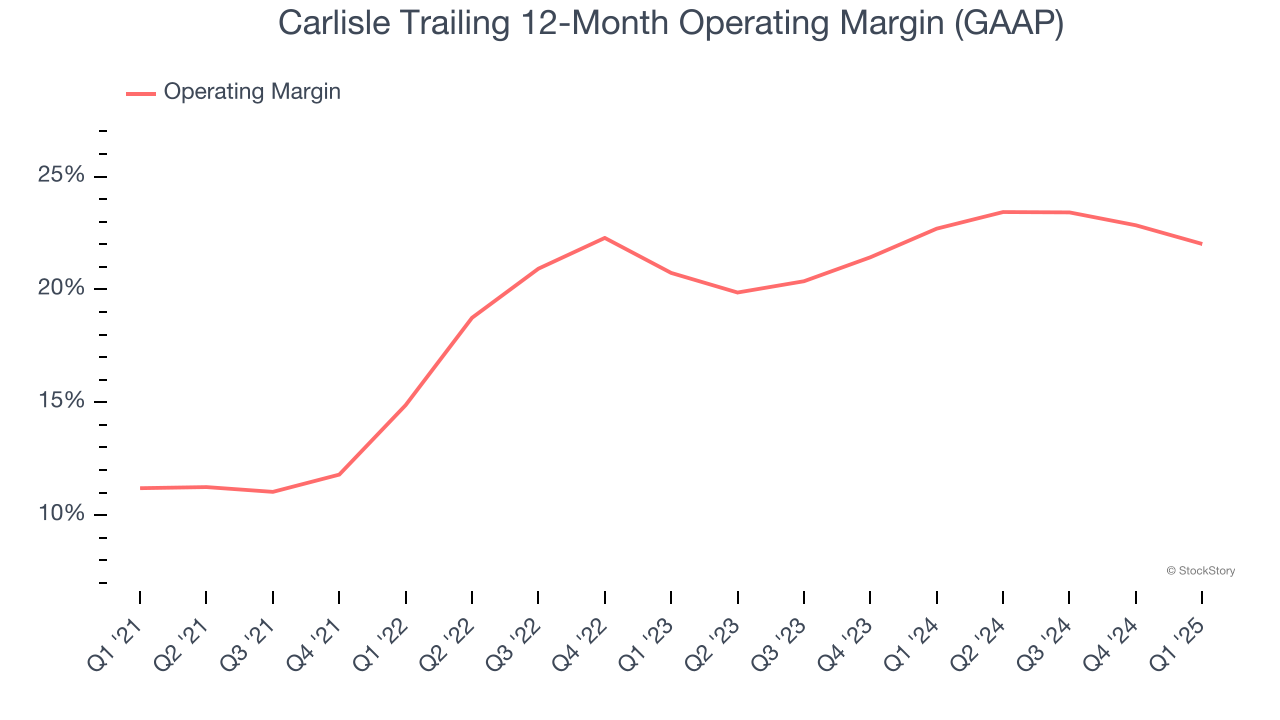

Carlisle has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.5%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Carlisle’s operating margin rose by 10.8 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q1, Carlisle generated an operating profit margin of 16.8%, down 3.8 percentage points year on year. Since Carlisle’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

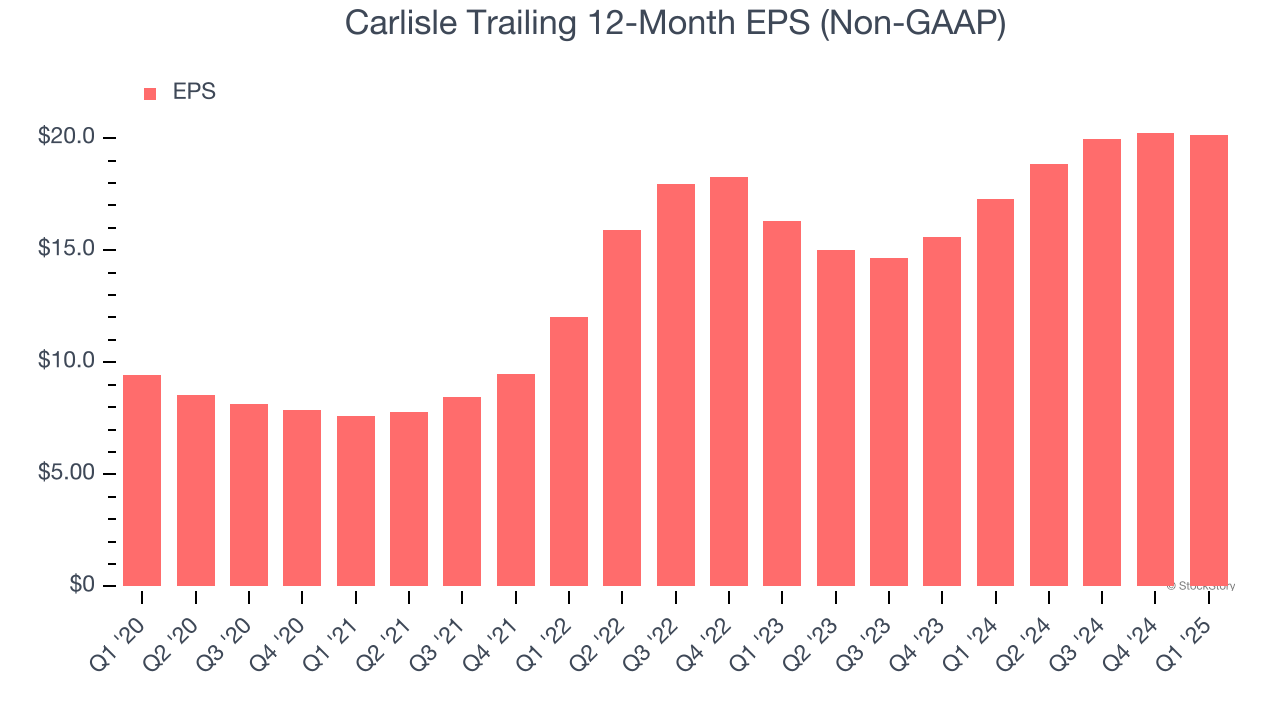

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

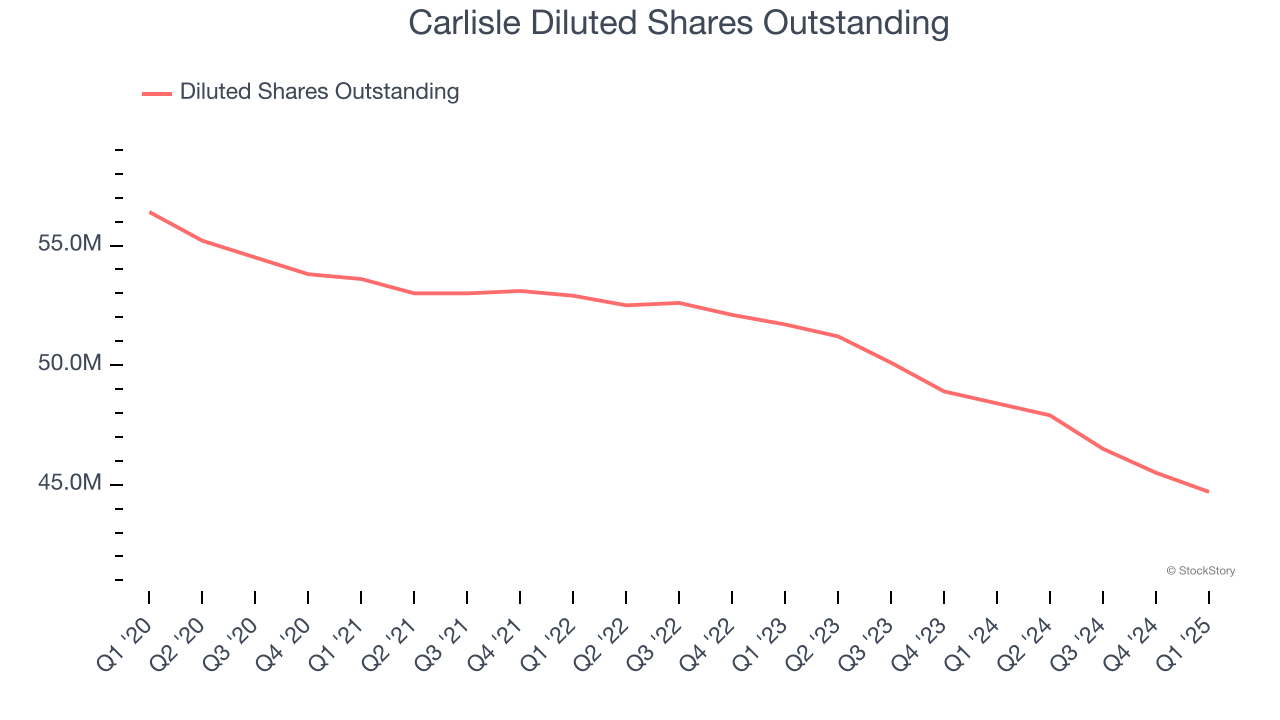

Carlisle’s EPS grew at a spectacular 16.4% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

We can take a deeper look into Carlisle’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Carlisle’s operating margin declined this quarter but expanded by 10.8 percentage points over the last five years. Its share count also shrank by 20.7%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Carlisle, its two-year annual EPS growth of 11.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q1, Carlisle reported EPS at $3.61, down from $3.73 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 5.6%. Over the next 12 months, Wall Street expects Carlisle’s full-year EPS of $20.13 to grow 12.7%.

Key Takeaways from Carlisle’s Q1 Results

It was encouraging to see Carlisle beat analysts’ EPS and EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 1.4% to $365 immediately after reporting.

So should you invest in Carlisle right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.