Over the past six months, CONMED’s stock price fell to $43.42. Shareholders have lost 13.3% of their capital, which is disappointing considering the S&P 500 has climbed by 11.1%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in CONMED, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is CONMED Not Exciting?

Even with the cheaper entry price, we're cautious about CONMED. Here are three reasons you should be careful with CNMD and a stock we'd rather own.

1. Lackluster Revenue Growth

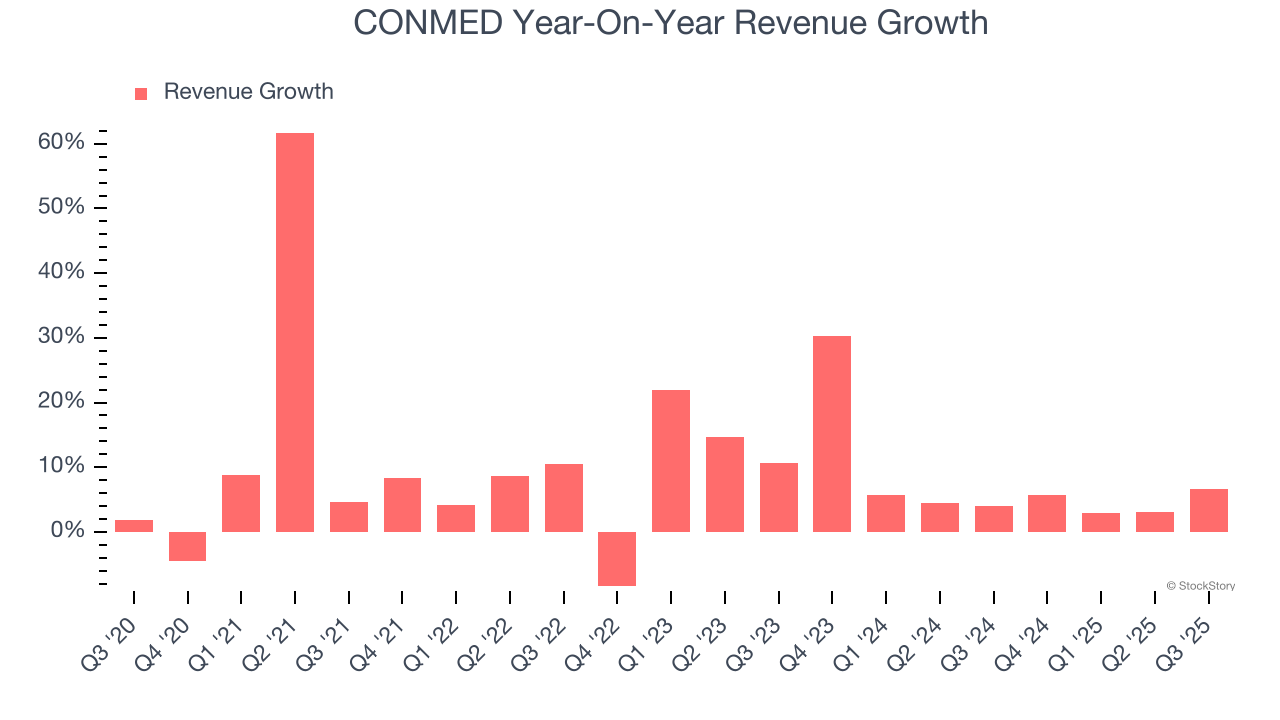

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. CONMED’s recent performance shows its demand has slowed as its annualized revenue growth of 7.4% over the last two years was below its five-year trend.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.35 billion in revenue over the past 12 months, CONMED is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CONMED’s revenue to rise by 1.8%, a deceleration versus its 9% annualized growth for the past five years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Final Judgment

CONMED isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 9.8× forward P/E (or $43.42 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.