Metal coating and infrastructure solutions provider AZZ (NYSE: AZZ) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.5% year on year to $425.7 million. The company’s full-year revenue guidance of $1.66 billion at the midpoint came in 1.4% above analysts’ estimates. Its non-GAAP profit of $1.52 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy AZZ? Find out by accessing our full research report, it’s free for active Edge members.

AZZ (AZZ) Q4 CY2025 Highlights:

- Revenue: $425.7 million vs analyst estimates of $418.2 million (5.5% year-on-year growth, 1.8% beat)

- Adjusted EPS: $1.52 vs analyst estimates of $1.48 (2.5% beat)

- Adjusted EBITDA: $91.17 million vs analyst estimates of $90.37 million (21.4% margin, 0.9% beat)

- The company dropped its revenue guidance for the full year to $1.66 billion at the midpoint from $1.68 billion, a 0.7% decrease

- Management slightly raised its full-year Adjusted EPS guidance to $6.05 at the midpoint

- EBITDA guidance for the full year is $370 million at the midpoint, above analyst estimates of $365.1 million

- Operating Margin: 16.3%, up from 14.5% in the same quarter last year

- Market Capitalization: $3.32 billion

Company Overview

Responsible for projects like nuclear facilities, AZZ (NYSE: AZZ) is a provider of metal coating and power infrastructure solutions.

Revenue Growth

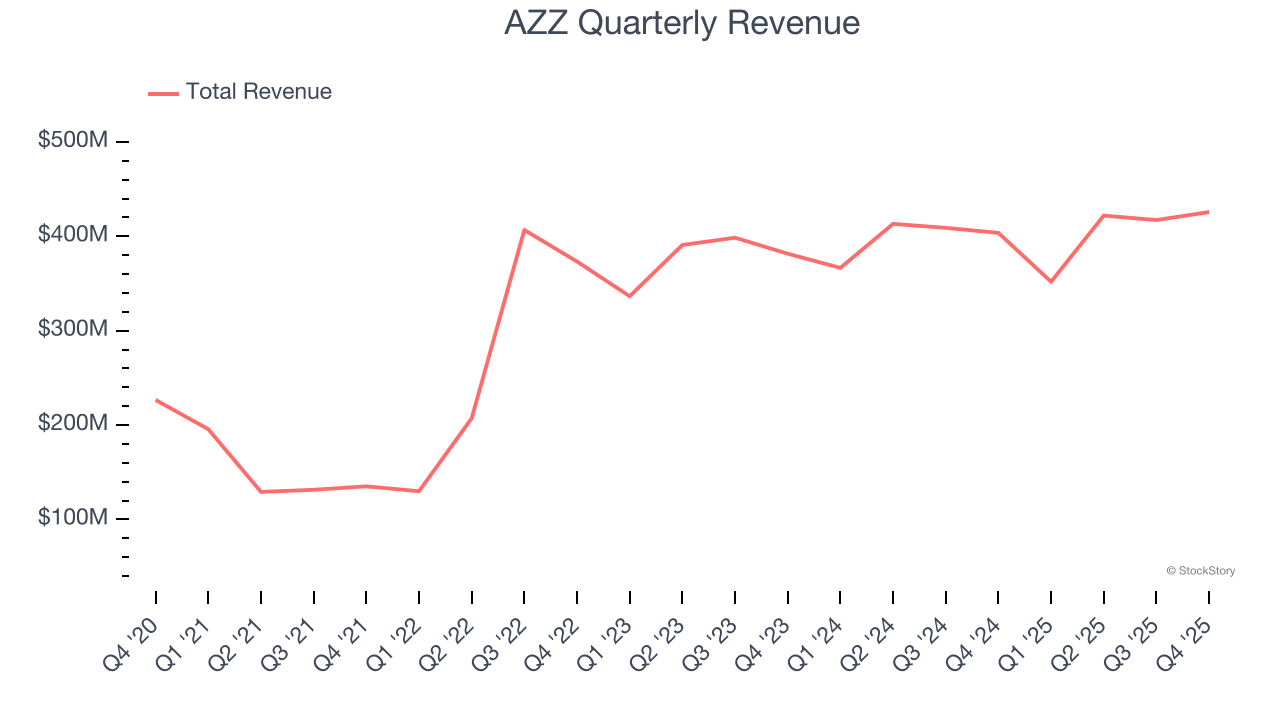

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, AZZ grew its sales at an excellent 12.7% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AZZ’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.6% over the last two years was well below its five-year trend.

This quarter, AZZ reported year-on-year revenue growth of 5.5%, and its $425.7 million of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

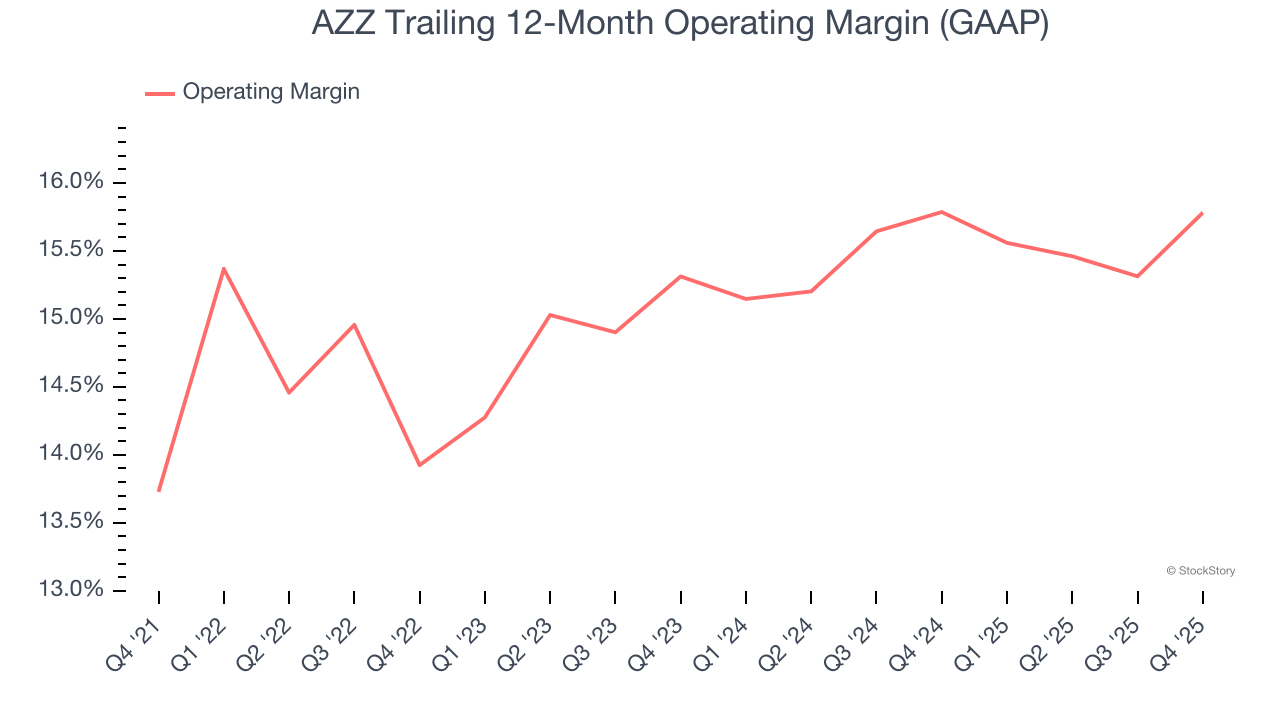

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AZZ has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, AZZ’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, AZZ generated an operating margin profit margin of 16.3%, up 1.8 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

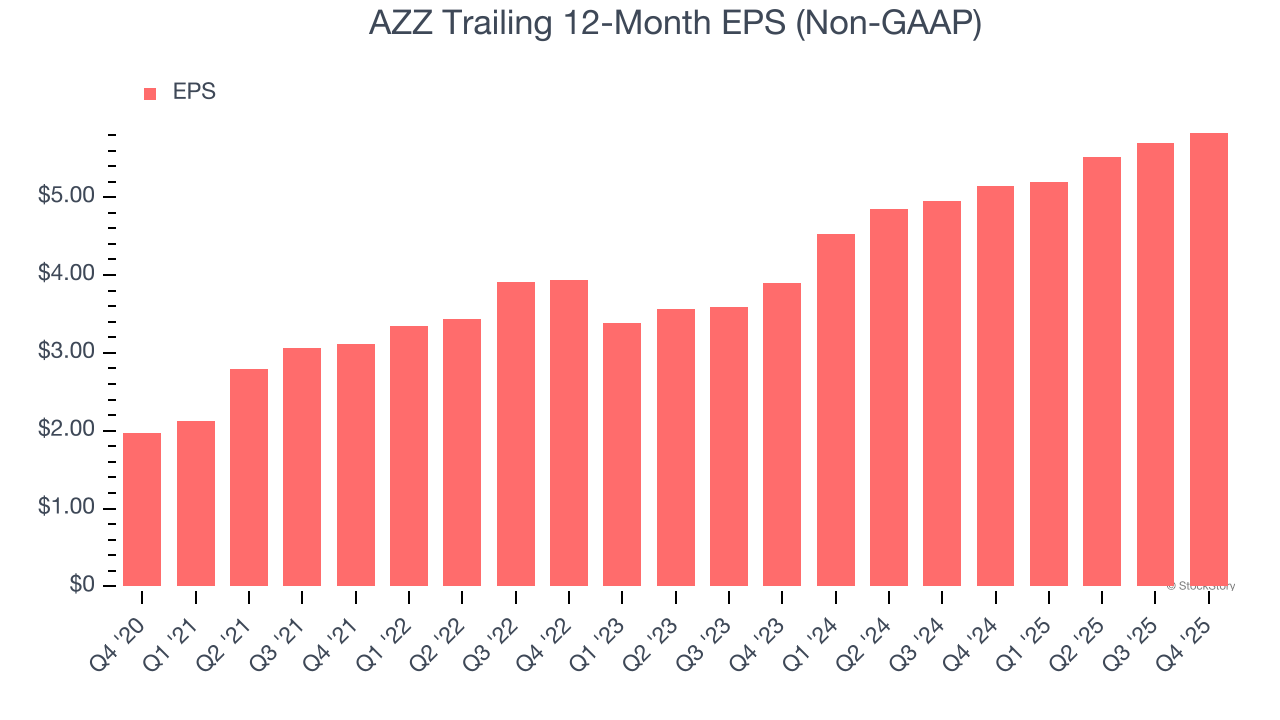

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AZZ’s EPS grew at an astounding 24.2% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of AZZ’s earnings can give us a better understanding of its performance. As we mentioned earlier, AZZ’s operating margin expanded by 2.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AZZ, its two-year annual EPS growth of 22.3% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, AZZ reported adjusted EPS of $1.52, up from $1.39 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects AZZ’s full-year EPS of $5.83 to grow 10.4%.

Key Takeaways from AZZ’s Q4 Results

We enjoyed seeing AZZ beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.2% to $113.50 immediately after reporting.

AZZ had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.