Community Bank has been treading water for the past six months, recording a small return of 2.2% while holding steady at $60.78. The stock also fell short of the S&P 500’s 11.5% gain during that period.

Is there a buying opportunity in Community Bank, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Community Bank Not Exciting?

We're sitting this one out for now. Here are three reasons you should be careful with CBU and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

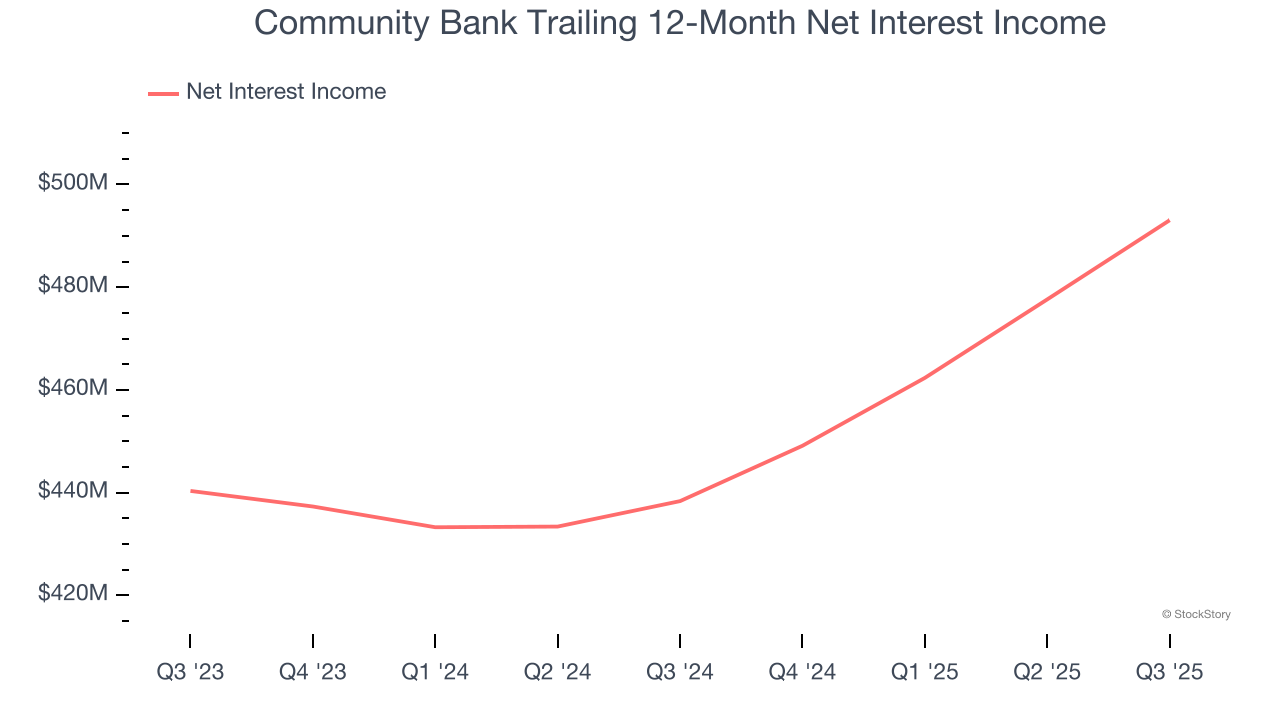

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Community Bank’s net interest income has grown at a 6% annualized rate over the last five years, worse than the broader banking industry and in line with its total revenue. This was driven by its loan growth as its net interest margin, which represents how much a bank earns in relation to its outstanding loan book, declined throughout that period.

2. EPS Barely Growing

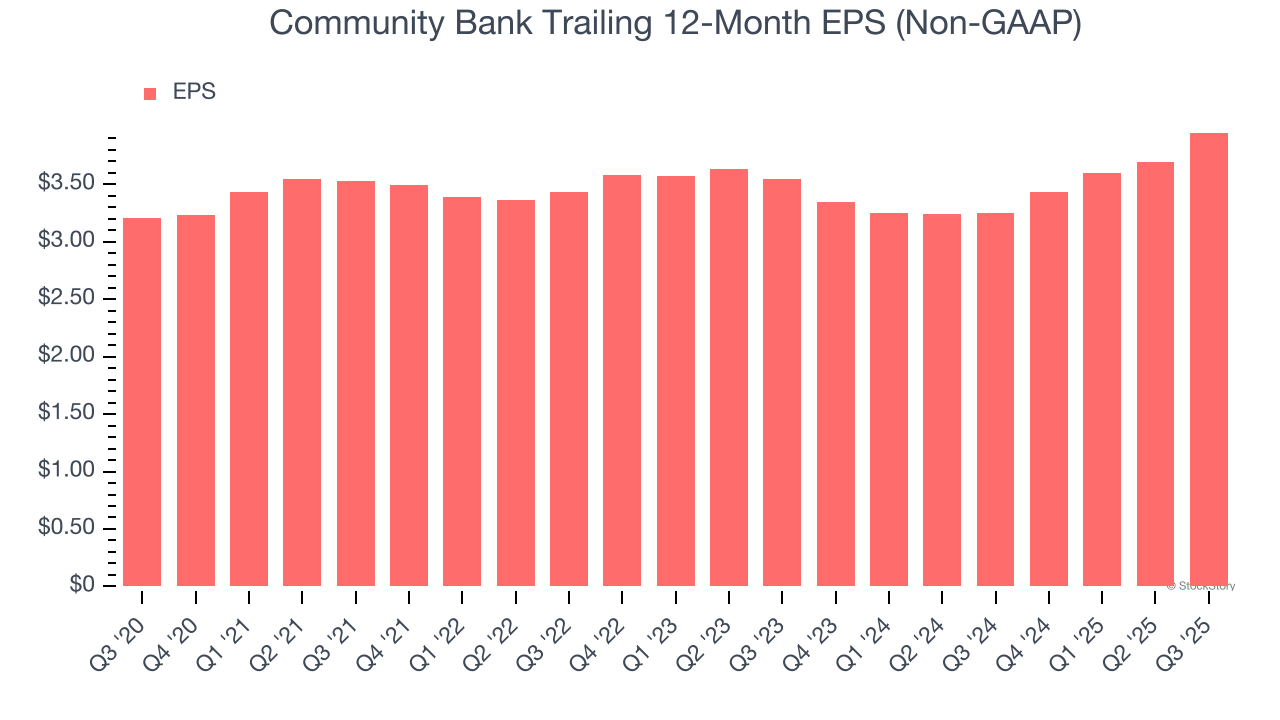

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Community Bank’s weak 4.2% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

3. Growing TBVPS Reflects Strong Asset Base

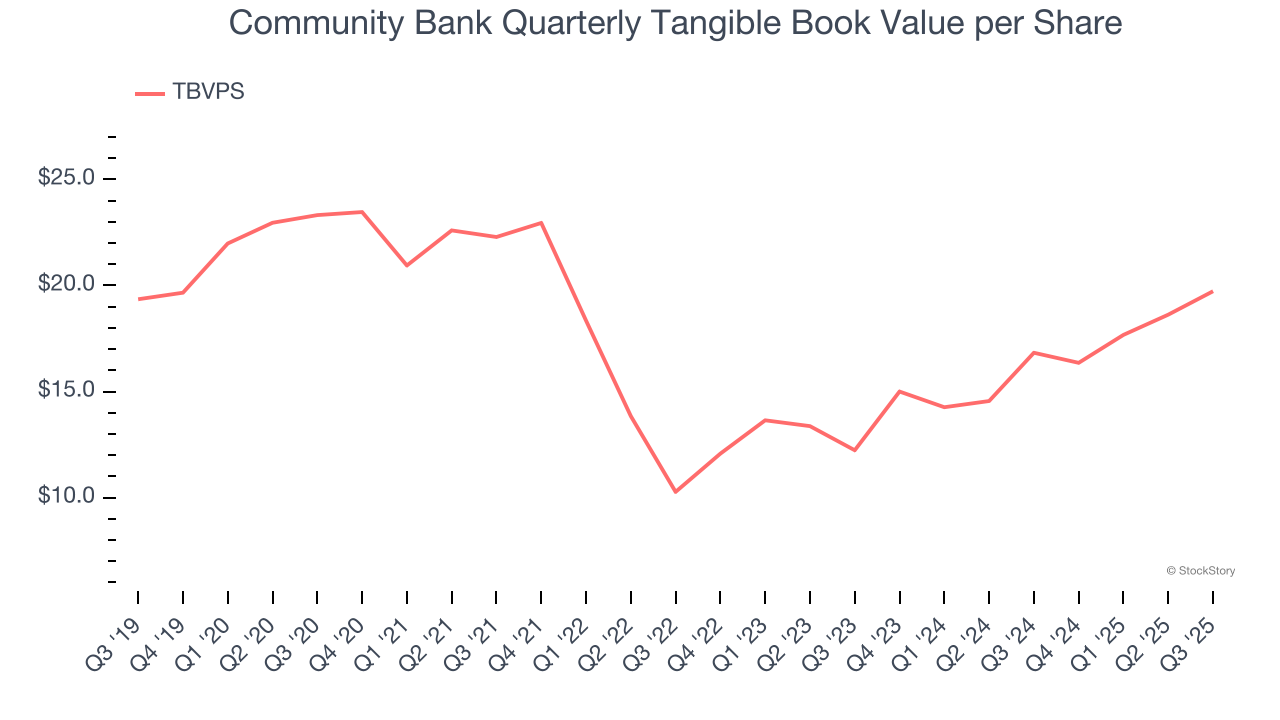

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although Community Bank’s TBVPS declined at a 3.3% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as TBVPS grew at an incredible 27% annual clip (from $12.23 to $19.73 per share).

Final Judgment

Community Bank isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 1.6× forward P/B (or $60.78 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Like More Than Community Bank

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.