Wheeeee!

Wheeeee!

Yesterday was fun, wasn't it? The Dow dropped 400 intra-day points – a 1.25% pullback as interest rates once again ticked higher – FREAKING investors out completely. Clearly the Fed is losing control of the narrative and that is really spooking investors and, with Fed rates currently set at 0.25%, there's a whole lot of spooking to come…

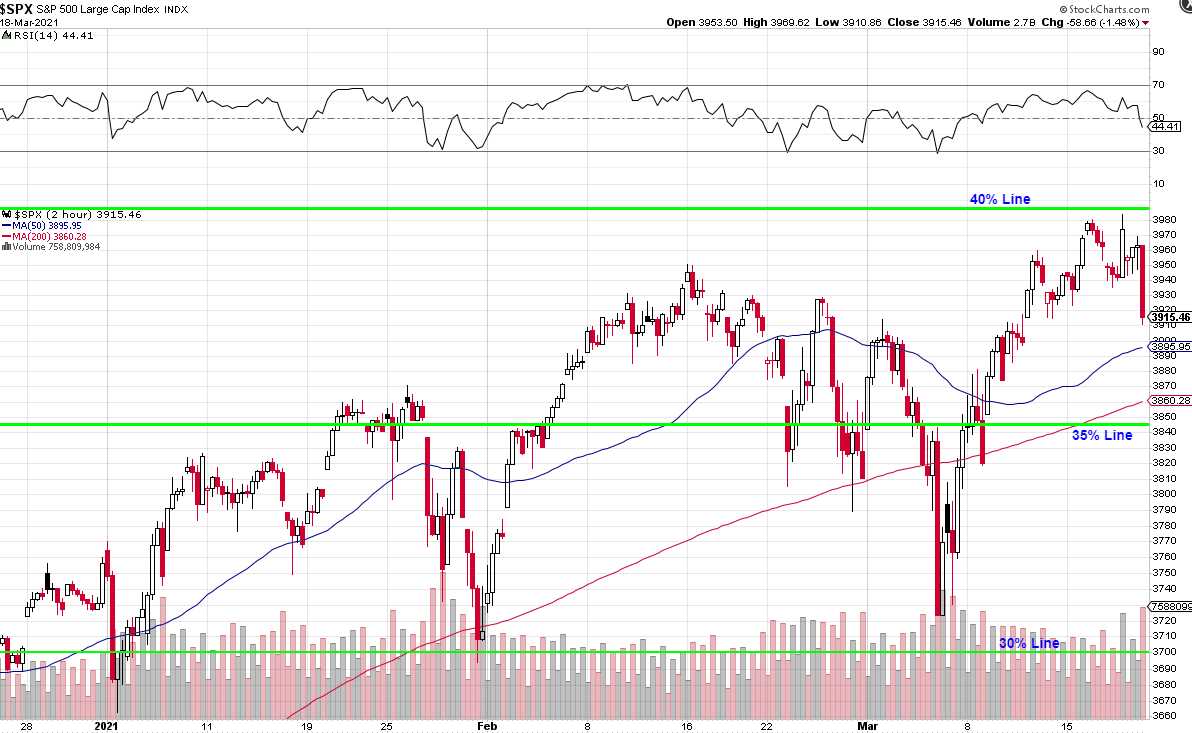

We're now negative for the week on the S&P 500 but of course we were going to be rejected at the 40% line (above 2,850) at least on our first attempt to cross over. From 30 to 40% has been just under 300 points so a 60-point (20% of the run) weak rejection (back to 3,930) was the least we'd expect and 3,870 would be the stronger rejection and is also the rising 200-day moving average, so it has a good chance of holding the first time as well, which means we didn't feel compelled to do anything drastic as we're certainly well-hedged enough to deal with a 5% correction – back to 3,845 (the 35% line).

As you can see, overall we're back to where we were mid-February – so no progress in the past month yet, to hear the pundits on TV – you would think this rally is going strong, wouldn't you? And, keep in mind this was the month we officially passed a $1.9 TRILLION spending bill. I wonder what we'll do to support the market next month? As I noted on Monday – we're likely into the post-Fed blues and soon we get our Q1 earnings reports and I don't think they are going to look like 6% GDP growth, will they?

Of course hope will spring eternal for Q2 and our $1.9Tn spending spree as all those stimulus checks hit people's bank accounts but most of that money will go to paying off rents and credit card bills – not into shopping and services. That makes the Retail ETF (XRT) a fun short at $90 as that's FRIGGIN' INSANE since 50 was normal pre-crisis so XRT is probably a little ahead of itself here:

Do you think Retail Sales and profits are up 100% from 2019? Probably not. I love betting that reality will re-assert itself…