(Please enjoy this updated version of my weekly commentary published January 3, 2022 from the POWR Growth newsletter).

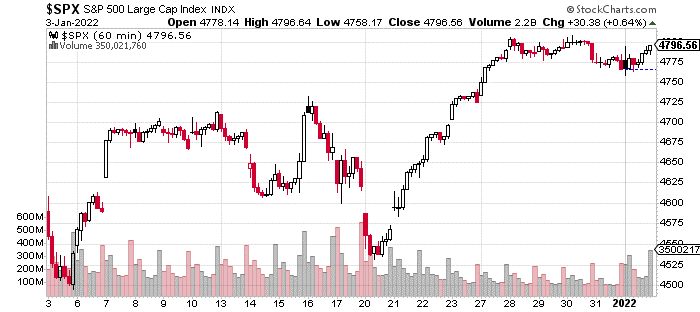

First, let’s check out the previous week’s range-bound action:

Essentially, the S&P 500 has been locked in a tight range between 4,740 and 4,800. Today, we tested the bottom of this range and seem to be moving to the upper-end of this range.

One constructive development during this market “pause” or “breather” is that the small-caps also remained range-bound. Note the difference between the last consolidation period from December 7 to 13, when small-caps were sliding lower.

This is a postive development and a harbinger of strong gains for the type of stocks that populate the POWR Growth portfolio.

Given that the market was up nearly 5% in the previous week, this type of tight, range-bound action is consistent with our belief that the market remains in the midst of a “melt up”. A defining feature of these environments is that the market either moves higher or moves sideways with only brief spurts of selling that is quickly overwhelmed with buying.

Big-Picture Topics

Last week, I touched on inflation and earnings growth which are the two biggest factors that will affect the stock market as a whole.

To recap: Inflation is likely to remain elevated. Longer-term, sticky measures of inflation are rising, while some of the short-term, abberational inflationary components are rapidly improving. So, inflation will moderate but remain above the Fed’s target. Thus, we should expect rates to continue rising which is a headwind for stocks.

But, the earning growth picture remains constructive, and Wall Street looks pessimistic with most forecasts in the 5 to 10% range for earnings growth. I hypothesized why I believe earnings growth will be in the 20% range as some cost pressures subside, and demand remains strong.

So, overall the earnings growth tailwind will be more powerful than the headwind from rising rates.

In terms of my overall forecast for the market, I am expecting 2022 to end with a modest 5% gain. But, at some point, I believe the market will be up more than 15% (Q2-Q3) and down by more than 10% from its YTD start point of 4,780 before ending the year flat.

So, yes, a decent amount of volatility that should present plenty of opportunities.

Here are some additional thoughts on various market components:

Bonds

One puzzling part of the market is the lack of weakness in bonds despite the Fed getting more hawkish, tapering asset purchases, rising inflation, and the improving economic outlook.

In 2021, the 10-Year was basically range-bound for most of the year, and shorter-term rates only started to move higher in the latter part of the year when the Fed finally got more hawkish.

This year has started off with weakness in bonds as the 10-year yield climbed 116 basis points, while the 2-year yield is at 0.80%. I’m expecting this trend to continue at least in the first part of the year for the reasons mentioned above.

It’s also interesting to note that typically on the first couple of trading days of the year, bonds are strong especially following years of strong stock market performance as portfolio managers rebalance. Thus, my interpretation is that there is signnificant supply and latent selling pressure in bonds, and we could get a big move higher in rates.

Energy

Oil prices and the 10-year yield do often trade in tandem, so it’s not surprising that oil was also particularly strong.

From mid-November to early December, oil dropped about $20 from $84 to $64, primarily due to omicron concerns. Now, oil has recovered about half of these losses, and I’m expecting it to retake these levels and make its way to $100.

Rising oil prices could also be a headwind for certain stocks reliant on consumer spending but very bullish for oil companies which remain very cheap. I expect oil demand to hit new highs in 2022 especially as travel volumes remain quite strong despite omicron.

Further, all the early clinical data seesm to indicate that omicron could truly be the variant that ends the pandemic due to its contagiousness, protection against all variants, and mild symptoms especially in vaccinated people and healthy, unvaccinated people.

Speculative Growth Stocks

“Speculative” growth stocks are one specific category of growth stocks that are often conflated with “growth” stocks. These are mostly high-multiple stocks that are priced as if they will grow at above-average rates for many, many years.

These performed very poorly in 2021, and I’m expecting this to continue in 2022. One factor supporting their performance was the relentless decline in rates which has reversed, and I expect to accelerate higher this year. Thus, I will continue to avoid this category of stocks and focus on companies with more tangible earnings.

What To Do Next?

The POWR Growth portfolio was launched in April last year and significantly outperformed the S&P 500 in 2021.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $477.84 per share on Tuesday afternoon, up $0.13 (+0.03%). Year-to-date, SPY has gained 0.61%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post The Big-Picture Topics for the Stock Market in 2022 appeared first on StockNews.com